American Superconductor (AMSC), an emerging provider of large-scale power solution resiliency solutions, has caught the attention of investors. The stock has experienced a roughly 205% increase over the past year, while its strategic acquisition of NWL, a provider of power supplies to industrial and military customers, is set to expand AMSC’s offerings, increasing its market reach and share.

Meanwhile, the company’s recent addition to the Russell 3000 Index could mean further increased visibility among investors. Its consistent growth makes AMSC a potentially appealing option for investors interested in an industrial goods provider to the power industry with upside potential.

American Superconductor Growing Through M&A

American Superconductor provides megawatt-scale power solutions, operating mainly through two segments: Grid and Wind. The Grid segment offers a variety of products and services primarily targeting electric utilities, industrial facilities, and renewable energy project developers. The Wind segment designs wind turbine systems and licenses the designs to third parties.

The company recently announced its acquisition of NWL, a private company with an average of approximately $55 million per year over the past three years. This acquisition is anticipated to speed up the expansion of AMSC, diversify its products, and widen its market presence and influence.

American Superconductor’s Recent Financials & Outlook

The company recently reported results for the first quarter of fiscal 2024. Revenue soared to $40.3 million from $30.3 million in the same period of fiscal 2023, primarily driven by an uptick in shipments of new energy power systems and electrical control systems. Net income came in at $3.0 million, or earnings of $0.08 per share, beating consensus expectations of $0.01.

As of the quarter’s end, cash, cash equivalents, and restricted cash amounted to $95.5 million, up from $92.3 million at the end of March 2024. The fiscal first quarter was marked by an influx of orders amounting to over $127 million, featuring its first Ship Protection System contract with an allied navy and a 3MW ECS order from Inox Wind, contributing to a total backlog worth $250 million.

Following the acquisition of NWL, management updated financial guidance for the second fiscal quarter ending September 30, 2024. Revenue is anticipated to be between $50 million and $55 million. As a result of higher expected revenues, the company forecasts positive cash generation between $1.0 and $4.0 million.

What Is the Price Target for AMSC Stock?

The stock has been highly volatile, sporting a beta of 2.54 as it climbed 106% year-to-date. It trades in the upper half of its 52-week price range of $5.78 – $32.70 and shows positive price momentum by trading above its 20-day (21.95) and 50-day (21.76) moving averages. With a P/S ratio of 4.7x, the stock trades at a relative premium to industry peers, with the Specialty Industrial Machinery industry average P/S ratio of 2.2x.

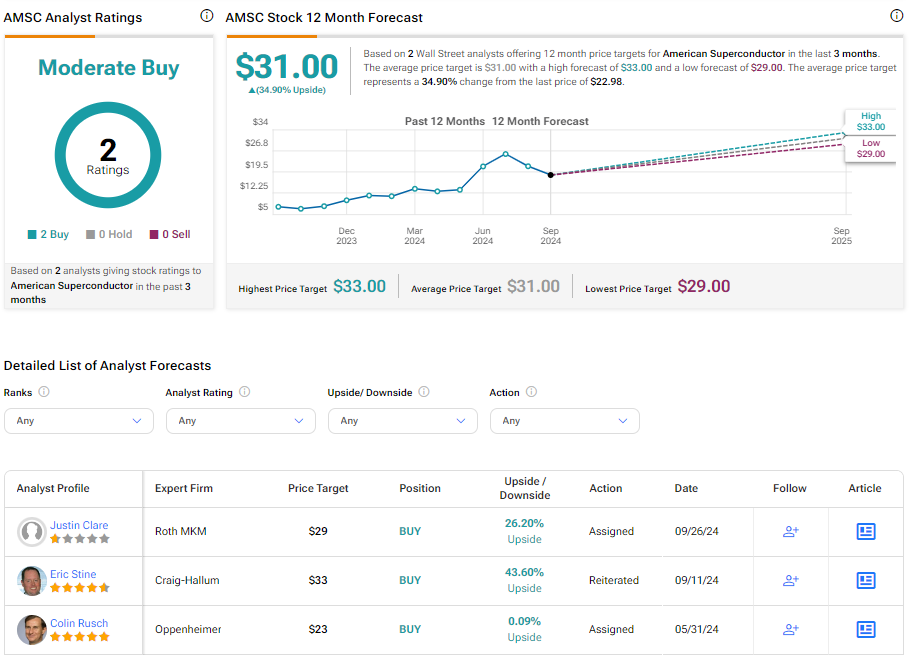

Analysts following the company have been bullish about AMSC stock. For instance, Roth MKM analyst Justin Clare recently reiterated a Buy rating on the shares and raised the price target from $27 to $29, noting the company provided healthy Q2 guidance after acquiring NWL at an attractive valuation.

American Superconductor is rated a Moderate Buy based on recent recommendations and price targets recently issued by two analysts. The average price target for AMSC stock is $31.00, representing a potential upside of 34.90% from current levels.

Final Analysis on AMSC

American Superconductor looks to build on its impressive recent financial results with anticipated Q2 revenue growth boosted by the recent NWL acquisition. The stock trades at a premium, likely reflecting the company’s upside potential. AMSC could be an appealing move for investors eyeing growth opportunities in the power sector.