Shares of credit card lender American Express (AXP), or Amex, are up about 25.8% year-to-date, outperforming the S&P 500’s (SPX) 9% gain, driven by strong fundamentals and a growing credit card business. Last month, Amex released its Q2 results. Although it slightly missed revenue expectations, the results were still decent. The company’s strong credit quality in Q2 indicates that its financials are on track. Given this, it’s an opportune moment to check who owns American Express.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Now, according to TipRanks’ ownership page, public companies and individual investors own 59.08% of American Express. They are followed by other institutional investors, mutual funds, and insiders at 21.22%, 18.78%, and 0.92%, respectively.

Digging Deeper into AXP’s Ownership Structure

Interestingly, Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) owns a 21.33% stake in AXP stock. Next up is Vanguard, the second-largest shareholder with a 5.56% stake in the company.

Currently, the Hedge Fund Confidence Signal is Negative on AXP stock based on the activity of 40 hedge funds. Hedge funds decreased their Amex holdings by 1.2M shares in the last quarter.

However, individual investors have a Very Positive view of the company. In the last 30 days, the number of portfolios (tracked by TipRanks) holding American Express stock increased by 4.5%. Overall, among the 750,738 portfolios monitored by TipRanks, 3.3% have invested in Amex stock.

Q2 Snapshot

Amex reported decent results, with revenue falling short of consensus but earnings surpassing expectations. The company posted revenues of $16.33 billion, up 9% year-over-year but below the $16.6 billion forecast. However, earnings per share increased 21% year-over-year to $3.49, beating the $3.26 estimate.

A key highlight from the Q2 report is the raised FY24 forecast. AXP now expects earnings for FY24 to be between $13.30 and $13.80 per share, up from the previous range of $12.65 to $13.15 per share. The company also expects revenue to grow 9% to 11% year-over-year.

Is AXP a Good Stock to Buy Now?

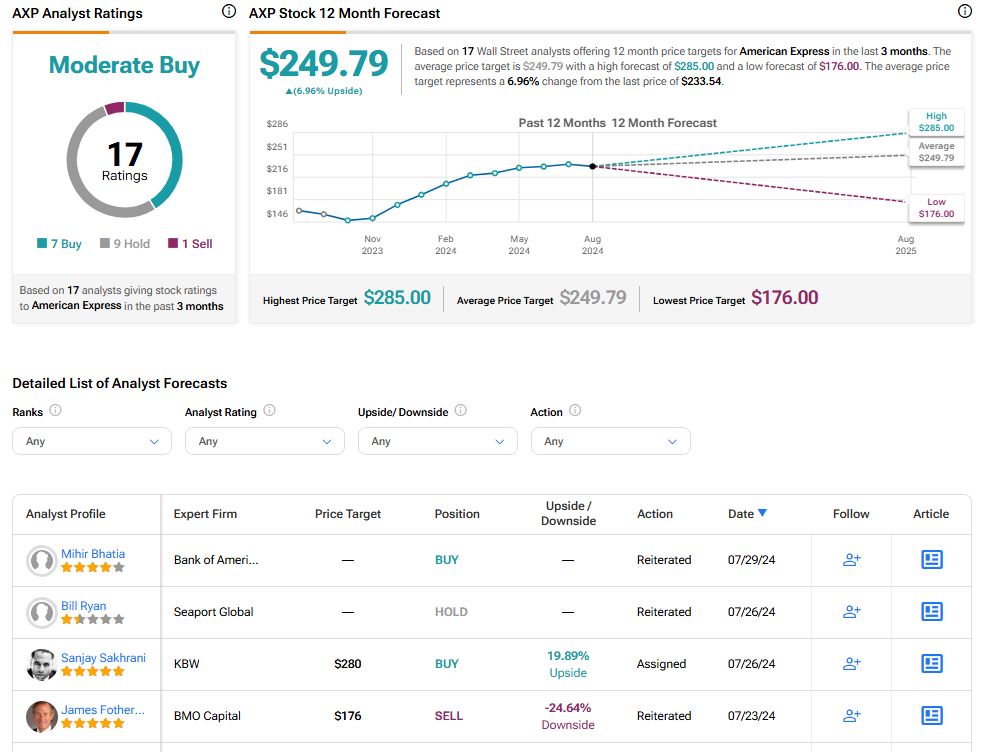

American Express has a Moderate Buy consensus rating based on seven Buys, nine Holds, and one Sell rating assigned over the last three months. Further, the average AXP stock price target of $249.79 implies about 6.98% upside potential from current levels.

Conclusion

TipRanks’ Ownership tool provides AXP ownership structure by category, enabling investors to make well-informed investing decisions. The company reported solid Q2 results and anticipates strong performance in the future.