I have been bullish on American Express for a while due to its rising profit margins and ability to gain market share in the credit and debit card industry. The latest quarter marked a major milestone, as American Express’ net profit margins exceeded 20%. However, that might be just the beginning of profit margin expansion, and this development presents a strong buying opportunity.

American Express Remains On Track for Long-Term Growth Plans

American Express management believe they can achieve 9% to 11% year-over-year revenue growth while delivering year-over-year EPS growth in the mid-teens. The company has been on pace so far, with revenue up by 10% year-over-year for the six months ended June 30, 2024. Furthermore, net income has surged by 37% year-over-year during that time. This supports my optimistic view.

I like that leadership is setting achievable goals and targeting solid growth rather than overpromising. Consumers should continue to use their American Express credit cards for various purchases, and the end of the recent port strike should be beneficial, in my view. A continued strike would likely have put inflationary pressure on the U.S. economy, which would have pressured consumer spending.

American Express’ growth is fueled by a young customer base. Most of the company’s new customers are millennials and Gen Z consumers. Furthermore, the company had 3.3 million new card acquisitions in the quarter. Continued card acquisitions will fuel additional revenue growth which should also strengthen profit margins.

Room for Profit Improvement

Researching the profit margins of other credit and debit card companies further highlights American Express stock’s appeal. It’s another reason to be bullish for AXP stock.

While American Express recently notched a 20% net profit margin, there’s still a lot of room for improvement. We can look at Visa (V) and Mastercard (MA), the two credit card giants, to get an idea of AXP’s long-term opportunity. Visa is the largest company in the industry and regularly posts net profit margins that are close to 55%. Meanwhile, Mastercard frequently delivers net profit margins that hover at around 45%.

It’s possible for Mastercard’s net profit margins to exceed 55% like Visa, but it will take a lot of time for the company to reach that level. While that’s already challenging enough, it’s even more difficult to envision Visa regularly posting 60%+ net profit margins. However, it’s not a moonshot for American Express to deliver 30% net profit margins within a few years. Should AMEX reach that benchmark, flat revenues would increase the company’s net income by 50%. Visa and Mastercard do not have this type of opportunity to improve their profit margins, and American Express can look toward Visa and Mastercard for inspiration.

The Valuation Is an Incredible Bargain

Despite posting 39% year-over-year net income growth in the second quarter and having a 20% net profit margin, American Express only trades at a 20x P/E ratio. This contributes to my bullish view, especially when V stock and MA stock are trading at 32x and 38x P/E ratios respectively. If American Express had a 30 P/E ratio — which is still lower than Visa and Mastercard — the stock could potentially rise 50%.

As American Express expands its profit margins while reporting top-line growth, investors are likely to focus on the relative valuation gap between AMEX and the 2 credit card peers. I don’t foresee American Express trading at an 20x P/E (18x forward) ratio forever, while Visa and Mastercard are trading at substantially higher multiples.

American Express even has the highest dividend among the three credit card giants. AXP stock has a 1.03% yield, while Visa and Mastercard yield 0.75% and 0.53%, respectively. Rising profit margins should result in an accelerated dividend growth rate. We got a glimpse of that this year when American Express hiked its dividend by 17%. That’s a higher dividend growth rate than for Visa and Mastercard.

Is American Express Stock a Buy?

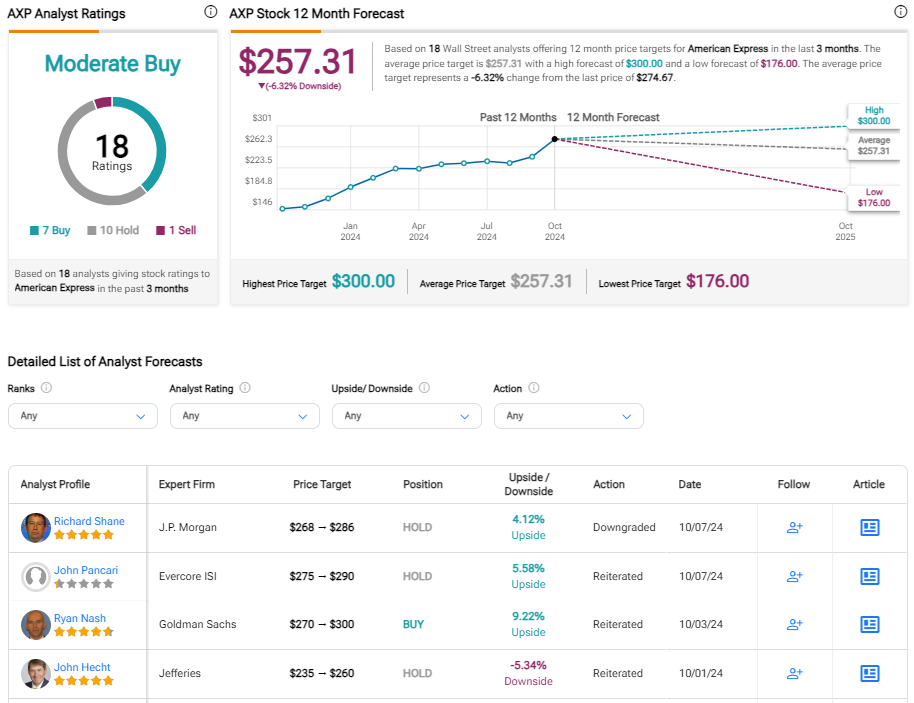

American Express is rated as a Moderate Buy among 18 analysts. The stock currently has seven Buy ratings, 10 Hold ratings, and one Sell rating. The average AXP price target of $257.31 is 6% lower than the recent trading price. However, recent price targets have been more optimistic. The highest price target of $300 suggests that shares can rally by an additional ~10%.

The analyst with that high price target on AXP shares is Ryan Nash from Goldman Sachs. Mr. Nash has a 67% success rate and a +17.4% average return on AXP stock.

The Bottom Line on American Express Stock

I expect American Express to continue expanding its profit margins in the years ahead. Its margins currently exceed 20%, but it may not be that long before American Express has a 30% net profit margin. This development would result in a significant upside for investors, but American Express already trades at a discount to its peers.

In my opinion, the discount isn’t warranted, as American Express has maintained similar revenue and net income growth rates to Visa and Mastercard. This mismatch presents a long-term buy opportunity for patient investors.