American Airlines Group Inc. (AAL) is planning to upsize its share and convertible bond sale to $2 billion, Bloomberg reports.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

According to the report the ailing US carrier will sell $1 billion of new shares in the offering, while a person familiar with the matter told Bloomberg that the shares will be priced at $13.50/share.

This represents a 10% discount to Monday’s closing price, with shares falling 7% during the day’s trading. That brings the stock’s total year-to-date loss to 48% as AAL grapples with the financial fallout of the travel freeze triggered by the coronavirus pandemic.

At the same time, the convertible note sale was also increased to $1 billion, with a set price of a 6.5% coupon and a 20% conversion premium, the Bloomberg sources said.

On Sunday the U.S carrier had revealed plans raise $1.5 billion from selling shares and convertible notes.

It is also proposing a $1.5 billion private offering of aggregate principal amount of secured senior notes due 2025, guaranteed on a senior unsecured basis by AAL, alongside a new $500 million Term Loan B Facility due 2024.

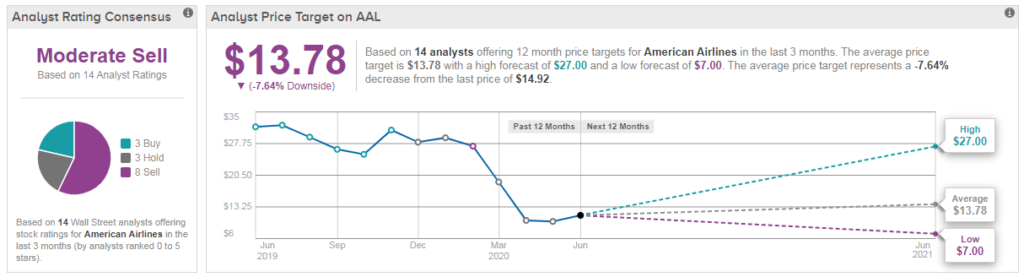

Overall, the Street has a Moderate Sell consensus on the debt-laden stock with analysts divided between 8 Sell ratings and 3 Hold ratings versus 3 Buy ratings. Most worryingly, the average analyst price target of $14 suggests further downside potential of 8% lies ahead.

However, five-star analyst Helane Becker at Cowen & Co recently raised American’s price target to $20 from $15, while maintaining a Buy rating, saying that the air carrier should have enough cash buffers to weather the crisis without having to file for Chapter 11 restructuring.

“We view the shares as a contrarian play and a stock that is likely to outperform as demand improves,” Becker wrote in a note to investors. Her price target now indicates 34% upside potential from current levels. (See American Airlines stock analysis on TipRanks).

Related News:

Global Airlines Are Set To Lose $84.3 Billion In 2020, IATA Says

United Airlines Secures $5 Billion Loan To Shore Up $17 Billion Liquidity Chest

Airbus Gets No New Aircraft Orders In May Amid Aviation Crisis