Amedisys, Inc. (AMED) inked a deal to acquire Contessa Health, to capture the growing market demand and evolving patient preference for higher-acuity, in-home settings. The financial terms of the deal have been kept under wraps.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of Amedisys, the leading healthcare at-home company offering personalized home health, hospice, and personal care, have jumped 19% over the past year.

Contessa Health enables patients to recover from acute or post-acute health conditions and surgical procedures from the comfort of their homes. Founded in 2015, it has partnerships with several health systems across the U.S. and has a strong pipeline for possible expansion, with over a hundred hospitals across more than 28 states.

The addition of Contessa’s higher acuity, home-based care is a great strategic fit to Amedisys’ current range of home-based services and will expand Amedisys Total Addressable Market (TAM) for in-home care services from $44B to $73B.

The acquisition is expected to close later this summer, subject to mandatory regulatory approvals. Upon completion, Contessa will function as a wholly-owned division of Amedisys. (See AMED stock chart on TipRanks)

Amedisys CEO Paul Kusserow, commented, “While Amedisys continues to be a national leader in quality home health and hospice services, we have always worked to innovate and provide even more types of care in the home, as patients increasingly seek to ‘age in place’ in environments that are familiar and safe. Bringing the Contessa team into our family significantly advances this strategy.”

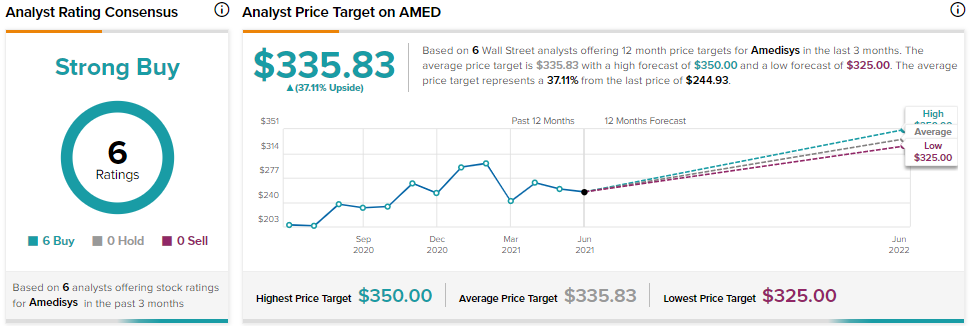

Jefferies analyst Brian Tanquilut recently maintained a Buy rating and the price target of $340 (38.8% upside potential) on the stock.

Tanquilut forecast the company to report earnings of $1.52 per share for the second quarter of 2021.

Overall, the stock has a Strong Buy consensus rating based unanimous 6 Buys. The average Amdisys price target of $335.83 implies 37.1% upside potential from current levels.

Related News:

Hewlett Packard Enterprise Boosts 5G Portfolio with Automated Solutions

Guidewire’s InsuranceSuite Selected by Mountain West Farm Bureau Mutual Insurance

XPO Logistics Prices Common Stock Offering of 5 Million Shares; Shares Drop