The chip industry is known to be highly cyclical, prone to periods of boom or bust based on supply and demand dynamics. Essentially, semiconductor companies will have a hard time when there’s an oversupply of product on the market, but can gain immensely once demand outstrips supply.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

And according to Bain & Company, we could be entering a period where the latter situation applies. The consulting services firm says an upcoming surge in AI-powered devices is expected to drive an increase in smartphone and PC upgrades. Combined with ongoing geopolitical concerns and other supply chain risks, this could result in a new chip shortage.

As a result, semiconductor companies could be heading into a highly lucrative period. However, not all players in the industry are equally positioned to capitalize on this AI-driven opportunity – some are better prepared to thrive than others.

With this in mind, Bank of America’s Vivek Arya, an analyst ranked in the top 1% of Street stock experts, has been taking a closer look at two industry heavyweights – Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC) – and finds one rather more appealing than the other right now. Let’s dive into the details.

Advanced Micro Devices (AMD)

We’ll start with AMD, a semi name that has been climbing up the chip ranks over the past 10 years. In fact, AMD was actually in danger of going bankrupt a decade ago but under the leadership of Lisa Su has made a huge turnaround to become the industry powerhouse it is today. Over the years, AMD has gained a reputation for offering competitive products that often deliver excellent performance at an affordable price.

Known for its high-performance processors and graphics cards, the company competes directly with Intel and Nvidia, providing CPUs for PCs, laptops, and servers, as well as GPUs for gaming and professional applications.

Taking advantage of the former’s myriad missteps, AMD has been steadily eating away at Intel’s CPU market share for the last few years. And while Nvidia remains the undisputed AI chip king, AMD is often seen as the one company positioned to give it a run for its money.

The strides being taken to do so were clear to see in AMD’s latest quarterly readout – for Q2. Data center revenue, driven by its AI chip offerings, hit a record $2.8 billion – a strong 115% increase year-over-year. Overall revenue grew by 9%, reaching $5.8 billion, surpassing expectations by $120 million. At the bottom line, adjusted EPS of $0.69 beat analysts’ estimates by a penny.

The company delivered on the outlook, too. For Q3, AMD anticipates revenue will be around $6.7 billion (plus or minus $300 million) while the Street was looking for $6.61 billion.

Bank of America’s Arya lays out the bull case for AMD, believing the company is poised to gain on several fronts: “Our Buy thesis remains that AMD is uniquely positioned to: 1) CPU Share gains: Capitalize in PC/server CPU share market by taking share from INTC that remains in turmoil with frequent restructuring, and 2) AI growth: Ride the expanding AI market (CY27 AI accelerator TAM at $400bn+ per AMD) where the leader NVDA continues to expand the addressable market that is always looking for alternative merchant and ASIC suppliers.”

“The result,” Arya summed up, “is a long-term sales CAGR between 15-20%, supporting annual earnings growth in the 20%-30% range, justifying forward PE multiple in the 30x-40x range, conceptually.” (To watch Arya’s track record, click here)

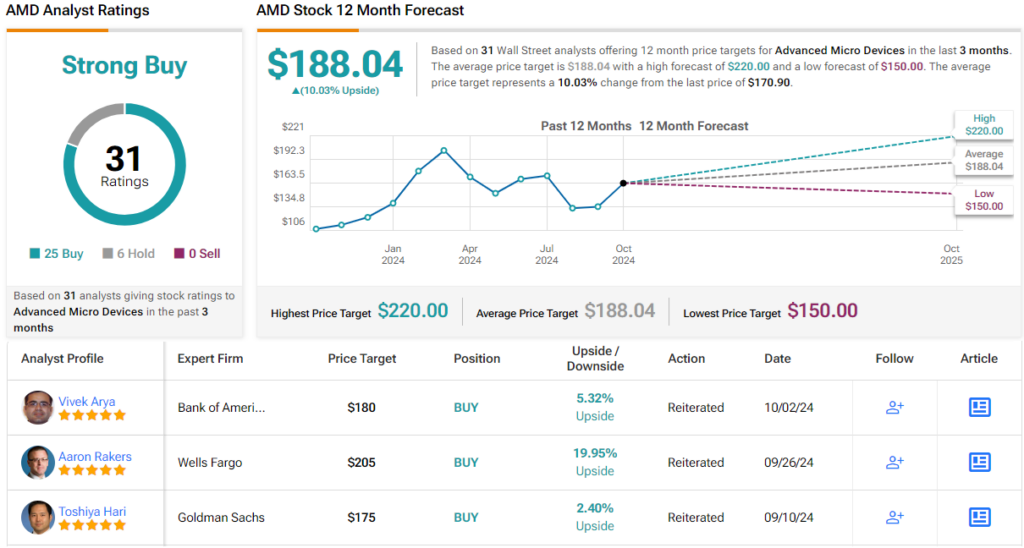

Most of Arya’s colleagues agree with that stance. The stock claims a Strong Buy consensus rating, based on a mix of 25 Buys vs. 6 Holds. The average price target stands at $188.04, implying a one-year returns of 10%. (See AMD stock forecast)

Intel

Let’s now take a look at Intel, a company that is almost a mirror image of AMD. Whereas AMD has risen from the ashes to become a big player in the industry, this fallen semi giant has faced multiple challenges in recent years, seriously affecting its once-dominant market position.

It has had delays in advancing its manufacturing processes, and these have impacted its ability to compete in both consumer and data center markets. Additionally, as mentioned above, Intel has faced stiff competition from AMD, whose Ryzen and EPYC processors have gained significant market share. Intel’s efforts to expand into areas like GPUs and AI chips have also been met with mixed results while organizational changes and leadership turnover have also played their part in Intel’s decline.

The result has been a sharp drop in Intel’s financial performance such as the one on display in its most recent earnings release, for Q2, which offered little comfort for investors.

In the quarter, revenue reached $12.83 billion, down by 0.9% year-over-year and falling under the forecast by $150 million. At the other end of the scale, adj. EPS of $0.02 missed analyst expectations by $0.08.

The outlook was even worse. Q3 revenue is expected to hit the range between $12.5 and $13.5 billion, some distance below the $14.39 billion Wall Street was after. The company also called for an adjusted loss of $0.03 per share, but the analysts were looking for much better than that in its forecast of $0.30 adj. EPS.

For Bank of America’s Arya, there are just too many challenges the company needs to address before it can be considered ready for investment again.

“Our fundamental view remains Underperform as we believe INTC faces a unique confluence of competitive, financial and strategic threats with no immediate positive catalyst,” the analyst opined. “We note the Intel 18A node progress is critical to turnaround, but there has been no external proof points of success. Just calling the internal manufacturing line ‘foundry’ or ‘subsidiary’ seems insufficient to attract external customers several of whom compete against INTC. The foundry business is under a third leader in the last 3 years, and external customer sales is expected to be <$300mn in CY24E, <$1bn in CY25E or <1% of global foundry market.”

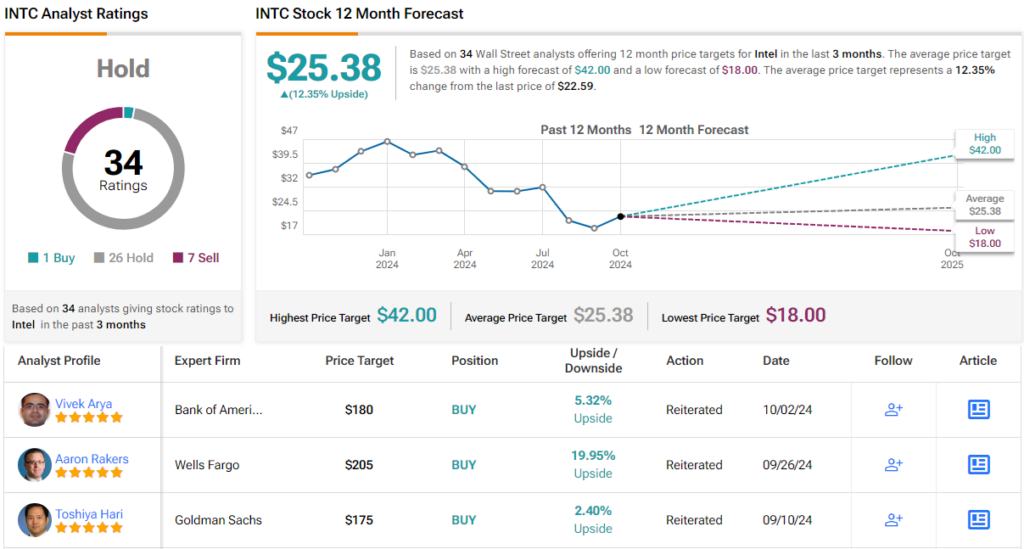

So, that’s Bank of America’s view, what does the rest of the Street have in mind? Overall, only one analyst still holds a Buy rating for Intel, but with an additional 26 Holds and 7 Sells, Intel stock claims a Hold consensus rating. Considering the shares have shed 55% year-to-date, the $25.38 average target now offers a one-year upside of 12%. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.