Shares of AMC Entertainment Holdings are soaring 14% after the largest US theatre chain announced plans to reopen about a dozen of its movie theatre locations in New York state, primarily in portions of Upstate New York and on Long Island, starting from Oct. 23. The move came after New York Governor Andrew Cuomo said on Saturday that “movie theaters outside of New York City can reopen at 25% capacity under state guidance starting October 23.”

AMC (AMC) said that “Beginning Friday, AMC will be serving guests in 44 of the 45 states where it has theatres, and all these AMC locations will abide by all state and local ordinances.” The company also expects to reopen more than 530 theatres in the US by the end of October.

Last week, AMC had warned of a potential cash shortage, if the movie theatres continued to remain closed. The company stated in a SEC filing that “Given the reduced movie slate for the fourth quarter, in the absence of significant increases in attendance from current levels or incremental sources of liquidity, at the existing cash burn rate, the Company anticipates that existing cash resources would be largely depleted by the end of 2020 or early 2021.” (See AMC stock analysis on TipRanks)

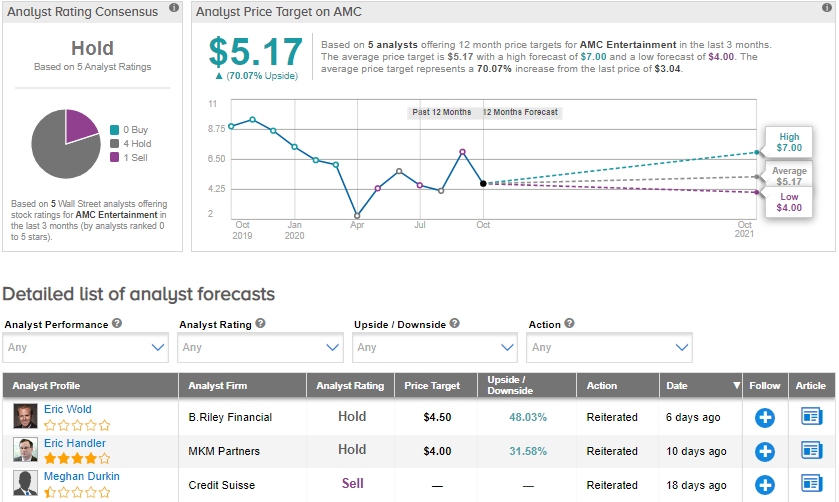

On Oct. 13, B. Riley Financial analyst Eric Wold said that “should the major US markets yet to reopen given the green light in the near-term, both the reaction to the company’s share price and ability to secure capital could be extremely positive.” The analyst maintained a Hold rating and a price target of $4.50 (48% upside potential) on the stock.

Currently, the Street is also sidelined on the stock. The Hold analyst consensus is based on 4 Holds and 1 Sell. Given the year-to-date share price decline of 54.7%, the average price target of $5.17 implies upside potential of about 70.1% to current levels.

Related News:

AMC Dips 6% Amid Cash Crunch Warning

Visa Nabs Strategic Stake In UK Fintech Company GPS

Atlassian Pops 9% On Accelerated Cloud Shift; Analyst Says Buy

Questions or Comments about the article? Write to editor@tipranks.com