Shares in AMC Entertainment Holdings Inc. (AMC) surged as much as 11% in pre-market U.S. trading amid reports that Amazon.com (AMZN) is interested in buying the debt-strapped theatre operator.

The world’s largest online retailer has held talks with AMC over a potential takeover, the Daily Mail on Sunday reported without saying where it got the information from. However, it is not clear if the discussions will lead to a deal, the report stated.

Amazon has not yet ventured into the cinema industry, while AMC is grappling with the financial fallout from theatre closures tied to the coronavirus pandemic. The world’s largest theatre operator is reportedly on the cusp of bankruptcy turning it into an attractive acquisition target.

AMC shares have almost halved since the coronavirus outbreak this year giving the theatre operator a market value of $427 million. The stock soared as much as 11% to $4.56 in U.S. pre-market trading.

Commenting on the reported acquisition talks, Eric Wold, analyst at B. Riley FBR said that he would be surprised if a purchase likely be for cash (and not stock) by Amazon would appeal to AMC’s major shareholders at a time when the stock is down near all-time lows.

“Although we have not anticipated that acquiring a theater circuit would be on the top of the strategy road maps for the major film studios – especially with the increased focus on the growth potential of streaming subscription offerings – we have not been able to completely rule out this possibility,” Wold wrote in a note to investors. “We would view increased control over the theatrical window through the acquisition of a large exhibitor as providing Amazon both an incremental earnings stream from its own films and an attractive marketing vehicle to drive additional subscribers being exposed to the studio’s films.”

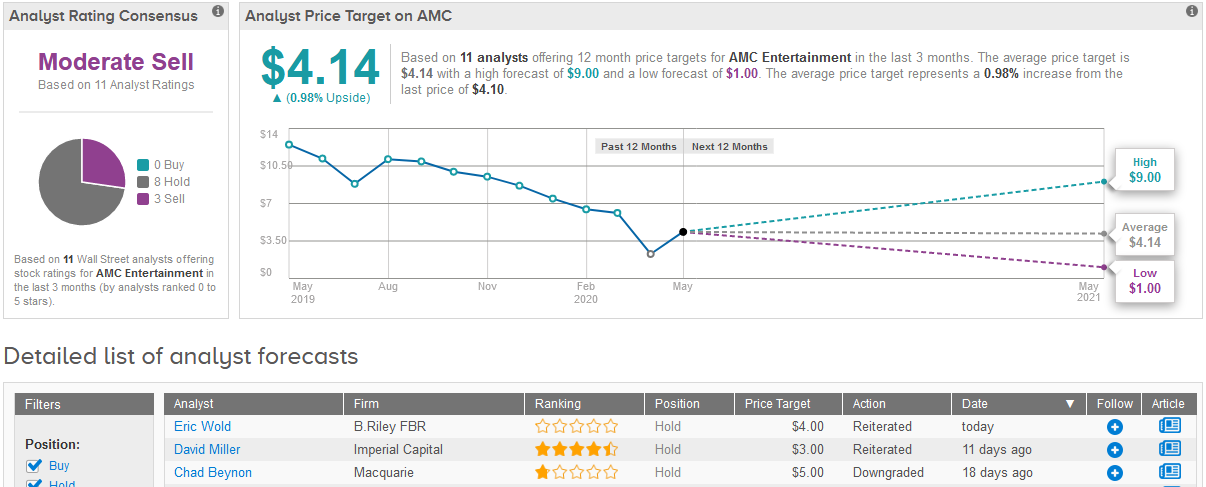

Wold maintained his Hold rating on AMC stock with a $4 price target

The remainder of Wall Street analysts also have a more bearish outlook on AMC’s stock. The assigned 8 Holds and 3 Sells add up to a Moderate Sell consensus rating. The $4.14 average price target implies limited upside potential in the shares in the coming 12 months. (See AMC stock analysis on TipRanks).

Related News:

Columbian Carrier Avianca Files For Bankruptcy Protection Due to Coronavirus Woes

ON Semiconductor Quarterly Earnings Miss Amid Virus Pandemic, Sees Orders Coming Back

Seres Therapeutics Reports Weak Earnings, But Significant Upside Lies Ahead