AMC Entertainment Holdings (NYSE: AMC) has reported a lower-than-expected loss in the fourth quarter of 2021. Also, total revenues beat analysts’ expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Remarkably, the company recorded the strongest quarterly results in the last two full years, with positive EBITDA.

Results in Detail

AMC incurred an adjusted loss of $0.11 per share, lower than the Street’s estimated loss of $0.26 per share. The company reported a loss of $3.15 per share in the same quarter last year.

Total adjusted revenues generated during the quarter came in at $1.17 billion against the Street’s estimate of $1.09 billion. Revenue of $162.5 million was recorded in the prior-year quarter.

Adjusted EBITDA stood at $159.2 million in the quarter, compared with negative adjusted EBITDA of $327.5 million in the fourth quarter of 2020.

Total attendance was 59.68 million, up from 8.09 million in the prior-year quarter.

As of December 31, 2021, the company operated 593 domestic theatres, which represented 100% of its domestic theatres, and 337 international theatres, reflecting around 95% of its international theatres. Stupendously, most of the company’s theatres were open in the fourth quarter.

Full-Year 2021 Results

For 2021, AMC reported an adjusted loss of $2.50 per share, significantly down from a loss of $16.15 per share in 2020. Total adjusted revenues of $2.52 billion more than doubled from the 2020 figure.

As of December 31, 2021, available liquidity and cash and cash equivalents stood at around $1.8 billion and $1.6 billion, respectively.

CEO’s Comments

In response to reported results, the CEO of AMC, Adam Aron, said, “Our positive recovery glide path from the global pandemic continued in earnest in the fourth quarter…The quarter offered moviegoers a more robust and appealing film slate that culminated with the exclusive theatrical release of the now third-highest grossing movie of all-time, SPIDERMAN: NO WAY HOME, despite having been released at the height of Omicron fears.”

Looking forward, Aron said, “We are quite bullish that for the full calendar year of 2022 the industry box office could be nearly double that of 2021, with COVID impacts easing, with more and more major films on the docket for release, and with most major studios coalescing around an exclusive theatrical window of 45 days or more.”

Wall Street’s Take

Overall, the stock has a Hold consensus rating based on 3 Holds and 1 Sell. The average AMC Entertainment price target of $11.75 implies 35.86% downside potential from current levels. Shares have gained more than 105% over the past year.

Risk Analysis

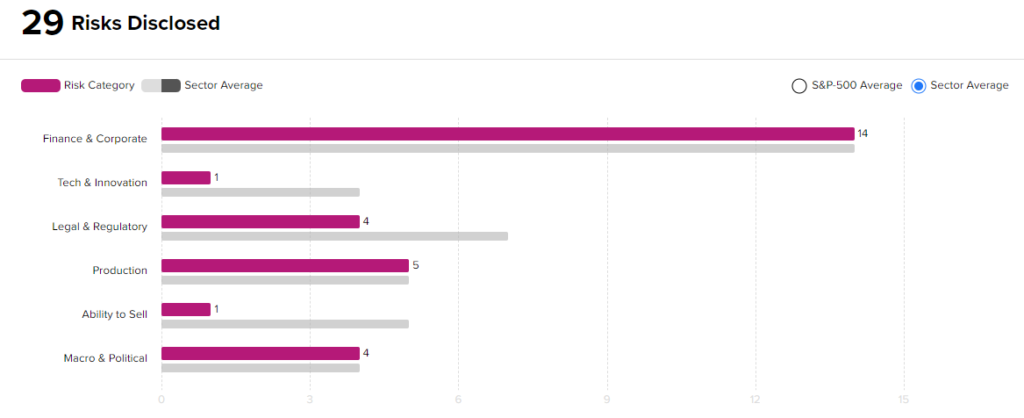

According to the new TipRanks Risk Factors tool, the AMC stock is at risk mainly from Finance & Corporate factors, which contributes 14 risks to the total 29 risks identified for the stock.

From a financial standpoint, AMC is at par with other companies in its industry. Therefore, given its risk profile, price movements, and strong numbers, investors might decide to hold this stock in their baskets.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Novavax Posts Larger-than-Expected Q4 Loss; Shares Slide

Biohaven & Pfizer Bags CHMP Positive Recommendation for Rimegepant

HP: Q1 Results Outperform, 2022 Guidance Upped