Shares of AMC Entertainment (AMC) are slightly up in after-hours trading after the movie theater chain released its second-quarter earnings results. Unsurprisingly, the company took a hit from a slow box office due to Hollywood strikes. The firm saw its revenue drop to $1.03 billion from $1.348 billion last year and reported an EPS of -$0.10 after seeing a profit of $0.09 per share. Still, EPS beat estimates of -$0.43, and revenue was in line.

In addition, CEO Adam Aron mentioned that while the second quarter started slowly due to strikes, it ended on a high note thanks to the success of Disney’s (DIS) Inside Out 2, which became the top-grossing animated movie ever. He also noted that June 2024 saw AMC’s highest-ever June Adjusted EBITDA in its 104-year history.

Nevertheless, AMC reported $34.6 million in net cash used for operations, compared to $13.4 million in the same quarter last year. As of June 30, the company had $770.3 million in cash, and its total debt was reduced to $4.34 billion from $4.58 billion at the end of 2023.

Is AMC a Buy, Sell, or Hold?

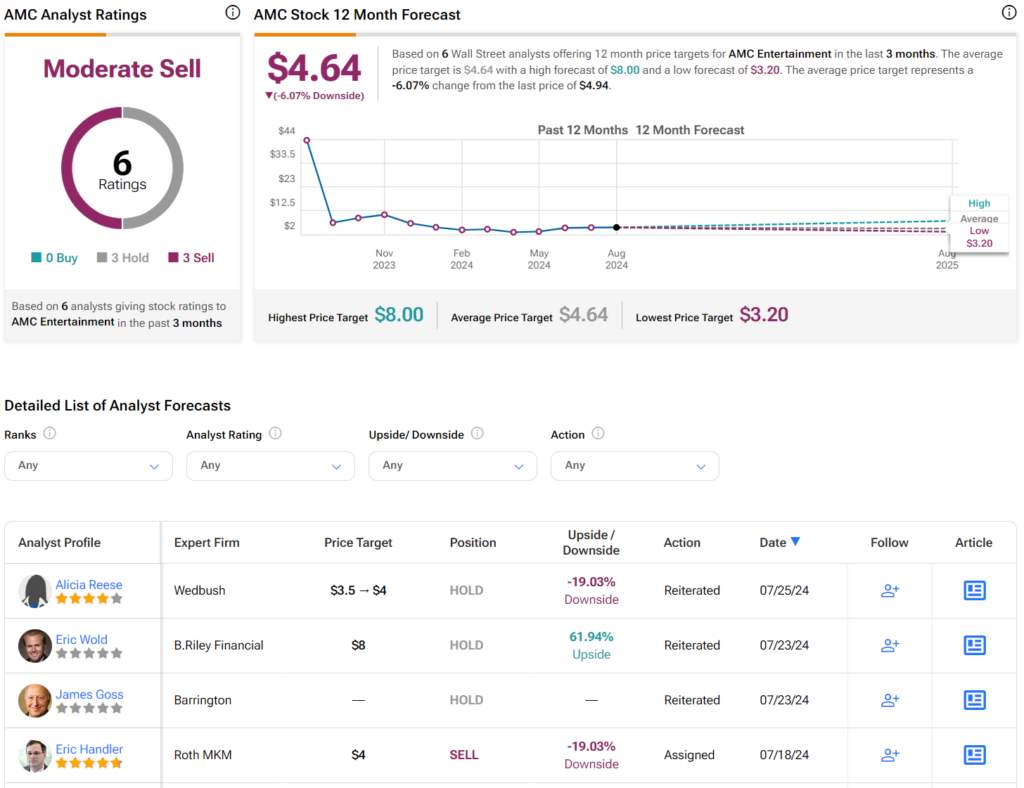

Turning to Wall Street, analysts have a Moderate Sell consensus rating on AMC stock based on three Holds and three Sells assigned in the past three months, as indicated by the graphic below. After an 89% decline in its share price over the past year, the average AMC price target of $4.64 per share implies 6.07% downside risk.