Shares in AMC Entertainment are sinking 13% after the cash-strapped theater chain announced plans to sell another 15 million shares in a public offering but warned that the move might not be enough to shore up the liquidity needed to avert a debt restructuring.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

According to an SEC filing AMC (AMC) is seeking to sell up to 15 million shares of its Class A common stock par value $0.01 per share. The theater operator said it expects total revenues for the three months ended September 30 to be approximately $119.5 million down from the $1.32 billion recorded during the same period last year. Furthermore, AMC estimated that its cash and cash equivalents as of September 30 was $417.9 million.

“The Company intends to use the net proceeds for general corporate purposes, which may include the repayment, refinancing, redemption or repurchase of existing indebtedness or working capital, capital expenditures and other investments,” AMC stated in the SEC filing. “In the event the Company determines that these sources of liquidity will not be available to it or will not allow it to meet its obligations as they become due, it would likely seek an in-court or out-of-court restructuring of its liabilities, and in the event of a future liquidation or bankruptcy proceeding, holders of the Company’s Common Stock would likely suffer a total loss of their investment.”

Earlier this year, AMC was forced to close its movie theaters worldwide and temporarily suspend operations as a result of the global lockdowns triggered by the coronavirus outbreak. As of last week, the company has resumed operations at 519 of its 598 US theaters, with limited seating capacities of between 20% and 40%. AMC disclosed that since the resumption of operations in its US markets, it recorded about 2.6 million guests as of October 16, representing a same-theatre attendance decline of about 85% compared to the same period a year ago.

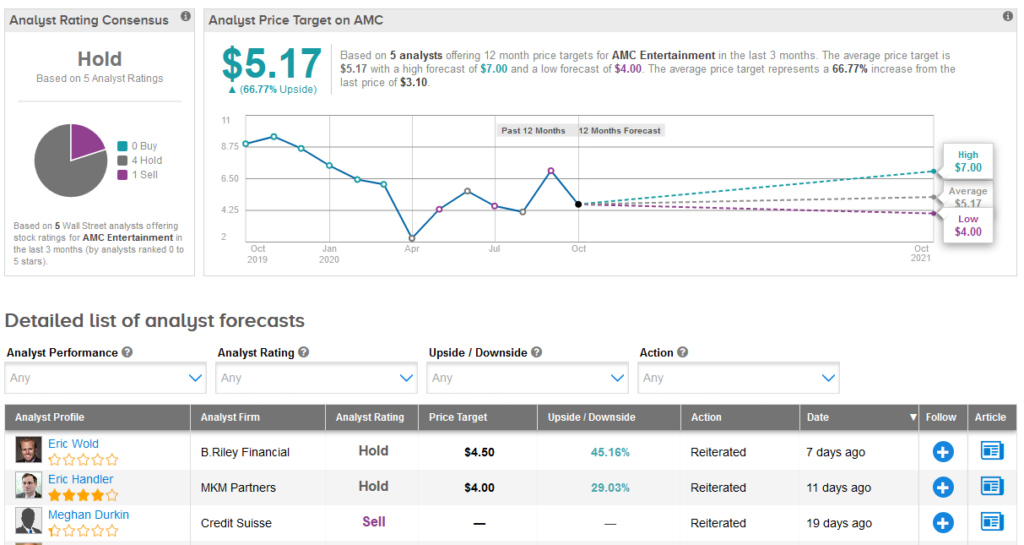

Shares in AMC have been hit hard and have plunged 58% so far this year, with analysts sidelined on the stock. The Hold consensus splits into 4 Holds vs 1 Sell. Meanwhile, the $5.17 average analyst price target implies a promising 67% upside potential in the shares over the coming year.

B. Riley analyst Eric Wold last week maintained a Hold rating on the stock with a $4.50 price target.

“Given the unlikely ability to complete any additional debt financings, we would expect continued dilution under additional equity offerings and/or minority investments in the company’s equity,” Wold wrote in a note to investors. “While we acknowledge that a Neutral stance for AMC shares may be too optimistic given our continued liquidity concerns, we also believe that should the major US markets yet to reopen given the green light in the near-term, both the reaction to the company’s share price and ability to secure capital could be extremely positive.” (See AMC stock analysis on TipRanks)

Related News:

AMC Dips 6% Amid Cash Crunch Warning

Visa Nabs Strategic Stake In UK Fintech Company GPS

Atlassian Pops 9% On Accelerated Cloud Shift; Analyst Says Buy