Amazon.com Inc.’s (AMZN) CEO Jeff Bezos is investing in UK freight and supply chain finance company Beacon.

The London-based company said that it raised over $15 million in its Series A fundraising round from investors including Amazon’s Bezos and US venture capital firm 8VC. The money raised will be invested in new hires, technology and market expansion.

Investors in Beacon’s initial seed round included Uber Technology (UBER) founders Travis Kalanick and Garrett Camp, former Google (GOOGL) CEO Eric Schmidt, as well as venture capital firms such as Neo, Red Sea Ventures, Manta Ray and FJ Labs.

Established in 2018, Beacon was founded by CEO Fraser Robinson and COO Dmitri Izmailov, both former Uber executives. The startup seeks to simplify and digitize how companies import and export goods globally and is engaged in the optimization of shipping routes and processes to reduce costs, while increasing booking speed and transport efficiency.

The company deploys AI, data science, cloud and automation technologies to unlock operational efficiencies.

“With digitalisation accelerating globally as a result of COVID-19, we believe the future of the traditional freight forwarder is more precarious than ever,” said Robinson. “Shippers are seeking technology-led products and services that will meet their needs more effectively, enhance their experience and cut their costs.”

It looks like Bezos is also looking for investment targets for Amazon as the economic crisis induced by the coronavirus pandemic is creating opportunities for mergers & acquisitions. The e-commerce giant is reportedly in talks to buy driverless vehicle startup Zoox Inc., in a deal that would expand its automation capabilities. The acquisition would also put Amazon in a position to offer food-delivery and ride-sharing services and grow to be a rival to automotive companies.

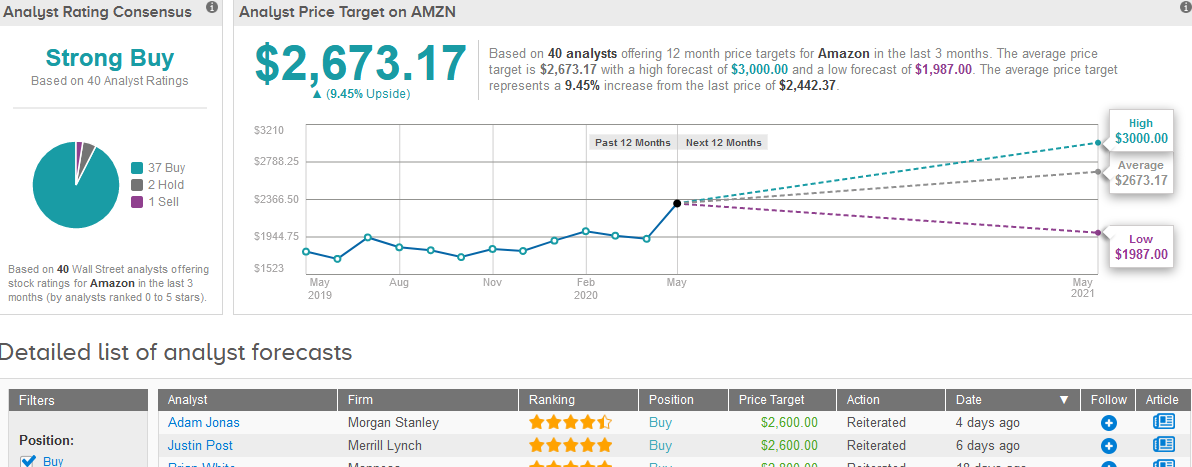

“AMZN’s innovation focus, capital to invest, and leading shipping volumes (and the miles driven along with them) make it one of the few companies that could build a product to compete with Waymo, Uber, Lyft and others,” five-star analyst Adam Jonas at Morgan Stanley wrote in a note to investors.

The analyst has a Buy rating on the stock with a $2,600 price target (6.5% upside potential to current levels).

Turning now to Wall Street, TipRanks data shows that overall analysts have a bullish outlook on Amazon stock. Out of the 40 analysts covering the shares in the last three months, 37 have Buys and the rest are split between 2 Holds and 1 Sell adding up to a Strong Buy consensus.

The $2,673.17 average price target still implies 9.5% upside potential in the coming 12 months despite the stock’s 46% rally since mid-March. (See Amazon stock analysis on TipRanks).

Related News:

Apple Snaps Up AI Startup Inductiv, As Analysts Boost PTs On Store Reopenings

KKR Invests $1.5 Billion in Reliance’s Jio Platforms In Biggest Deal In Asia

Microsoft Seeks $2B Stake In India’s Jio Platforms- Report