Amazon.com Inc. (AMZN) is planning to create another 1,000 jobs in Ireland amid a surge in demand for cloud services and in an effort to help propel the country’s economic recovery following the COVID-19 pandemic.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The new, highly skilled roles will be based in locations across the company’s Cork and Dublin sites in Blanchardstown, Tallaght, the city centre, and north County Dublin. The new hires will bring Amazon’s total permanent workforce in the country to 5,000 people.

Among the new jobs created are software development engineers, network development engineers, Dev Ops engineers, and support engineers, as well as data center technicians and security specialists, and big data specialists. The positions will be deployed in a range of technical management and senior leadership levels at both Amazon and Amazon Web Services (AWS).

“Amazon has been investing and growing in Ireland for over 15 years, and today, we are increasing that commitment with the creation of these highly skilled roles,” said Mike Beary, AWS Ireland Country Manager. “We have seen a surge in demand for cloud services in Ireland and globally, and we are excited to add 1,000 highly skilled roles so we can continue to help our customers, especially in this difficult time, and work towards building a robust digital economy for the future.”

In addition to the new jobs, Amazon is investing in a new 170,000 square foot Dublin campus in Charlemont Square. The campus will be home to AWS’s growing cloud computing workforce, and is expected to open in 2022. In September 2020, the first of Amazon’s wind farm projects in Ireland will come online.

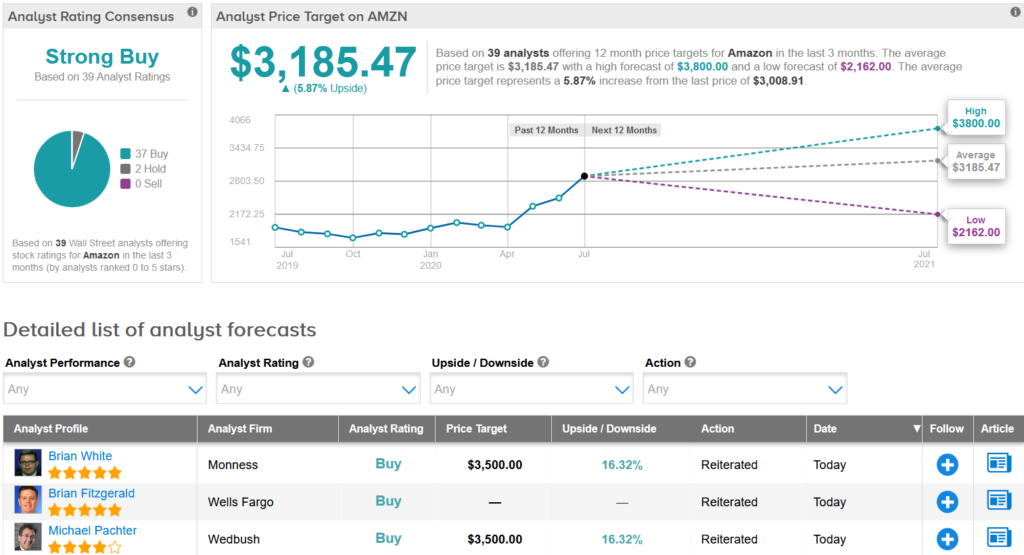

Shares in Amazon have been on a steady winning streak jumping 63% so far this year, with analysts maintaining a bullish outlook on the stock. The Strong Buy consensus boasts 37 Buys versus 2 Holds. In view of this year’s rally, the $3,185.47 average analyst price target implies a modest 5.9% upside potential in the stock in the coming 12 months. (See Amazon stock analysis on TipRanks).

Ahead of Amazon’s earnings release on July 30, Wedbush analyst Michael Pachter raised the stock’s price target to $3,500 (16% upside potential) from $3,050 and reiterated a Buy rating, saying that he expects significant top-line upside for Q2, but near- and long-term profitability remains difficult to predict.

“COVID-19 and the stay-at-home response for many consumers should result in substantial revenue upside in Q2, with the company’s burgeoning grocery business likely a key driver,” Pachter wrote in a note to investors.

Pachter forecasts Q2 revenue of $81 billion and operating income of $1.83 billion vs. consensus at $81.3 billion and $0.93 billion respectively.

Related News:

Amazon Invested In Startups And Then Launched Competing Products- Report

Apple iPhone SE Boosts Q2, But Unlikely To Cannibalize 5G Sales – Report

Amazon Exports From India-Based Sellers Crosses $2B Mark – Report