Amazon’s (NASDAQ:AMZN) cloud-computing unit, Amazon Web Services (AWS), is reportedly laying off hundreds of jobs to reduce costs. This move comes as AWS’s revenue growth has witnessed a slowdown, reaching its lowest point last year. The key reason for this decline is reduced spending by companies on technology upgrades due to rising interest rates.

The company has identified specific departments within the AWS unit for potential workforce reduction, notably in sales, marketing, and global services. Additionally, it intends to trim positions within its physical stores’ technology teams, who are responsible for the infrastructure supporting the company’s cashierless checkout initiatives. This strategic decision comes after the company’s recent announcement to discontinue the “Just Walk Out” technology in Amazon Fresh grocery stores.

Since the end of 2022, Amazon has undertaken several cost-cutting measures, starting with a mass layoff of approximately 27,000 employees. Also, it terminated workers at the Twitch, Audible, Prime Video, and MGM Studios divisions, among other subsidiaries.

Is Amazon a Buy, Sell, or Hold?

The company’s strong market presence and diverse offerings keep it well-positioned for growth. Furthermore, Amazon’s advertising business is expanding rapidly, which bodes well for revenue growth. Moreover, AMZN continues to invest in areas like artificial intelligence and healthcare, potentially opening new revenue streams.

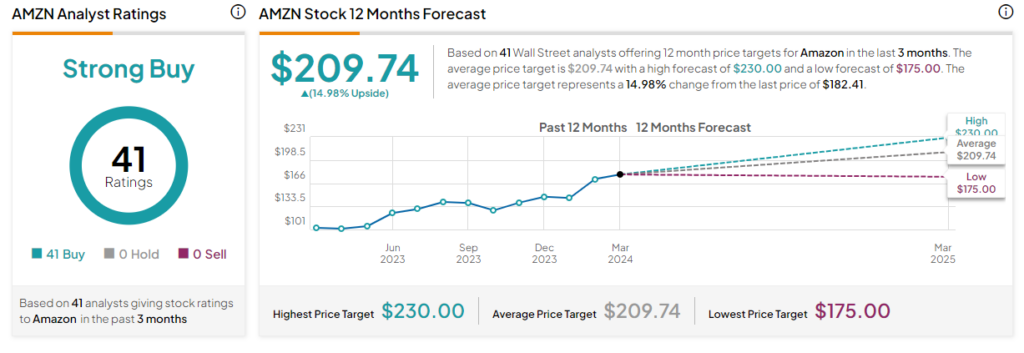

Currently, Wall Street is optimistic about AMZN. It has a Strong Buy consensus rating based on 41 unanimous Buy recommendations. After a year-to-date rally of nearly 20%, the analysts’ average price target on Amazon stock of $209.74 per share implies another 15% upside potential.