One of the most influential trends shaping our society today is the rapid expansion of artificial intelligence technology, particularly generative AI. Since the launch of ChatGPT two years ago, AI has steadily penetrated every corner of the digital landscape, and as our economy becomes ever more digital, these advancements are impossible to ignore.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

For investors, the AI boom presents substantial opportunities. From small startups and major chip manufacturers to e-commerce giants and tech powerhouses, countless companies are already being reshaped by AI – and many more will follow. Over the next few years, AI stocks are expected to drive the forefront of the investment landscape.

Loop Capital’s Rob Sanderson, a 5-star analyst rated in the top 4% of the Street’s stock pros, has been taking the measure of the AI opportunities – and he sees some clear differences among the giants in the field. Looking at Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL), both trillion-dollar-plus companies and both leaders in their fields, Sanderson has selected one as the superior AI stock to buy today. Let’s take a closer look.

Amazon

We’ll start with Amazon, the world’s leading online retail company. After surviving the tech bubble of the late 90s, and expanding beyond its origin as ‘the online bookstore,’ Amazon has grown into a behemoth, with a $2.18 trillion market cap and $575 billion in annual revenue last year.

Amazon’s core business is e-commerce, of all stripes. Buyers can find almost any imaginable product on the company’s website, and Amazon guarantees short-term delivery almost anywhere in the world. The company’s logistics network is justly famous; some of the warehouses exceed a million square feet, and Amazon has been a leader in warehouse automation and other technology, behind the scenes, to support its retail business.

Amazon didn’t reach the top of its game by waiting for others to find the path forward. The company is actively involved in two of the digital world’s leading-edge technologies, cloud computing and AI – and is putting them together.

The company is working on AI in tandem with the generative AI development firm Anthropic, which Amazon has backed to the tune of $4 billion. Anthropic’s Claude family of gen-AI models has been incorporated into Amazon’s Bedrock, a cloud-based AI platform available through AWS, Amazon’s cloud computing service. The upshot here is that for the user, Bedrock is serverless, giving access to top-quality AI tech without having to build up the infrastructure to support it. Amazon’s AWS is well-known and trusted already; the company is building on that to offer customers an AI application that can be safely integrated and deployed into existing apps using the customer’s existing AWS tools and subscription.

During the last quarter, Amazon launched several customer-facing AI tools, including Rufus, a shopping assistant available in Canada, the UK, and several European countries; AI Shopping Guides, to simplify shopping search on the site; and Project Amelia, an AI assistant designed for online sellers.

Turning to the financial side, we find that Amazon’s revenues and earnings are showing a steady growth pattern. In the last reported quarter, 3Q24, Amazon had a top line of $158.9 billion, up 11% year-over-year and $1.6 billion better than had been estimated. The company’s EPS of $1.43 beat the forecast by 29 cents per share, or more than 25%. Revenues from AWS grew at 19% year-over-year, and reached $27.5 billion.

Loop’s Sanderson is impressed by Amazon’s AI work, and the prospects it opens up for the tech giant. He says in his recent note, “The AI opportunity for AWS appears open-ended and AI-related revenue is ramping quickly, 3X faster than core AWS at the same stage of evolution. The positive fundamental backdrop for the cloud business is widely understood by investors, but we still think the retail business has much more earnings power than the Street recognizes… We are encouraged by underlying trends in both businesses and like the set up for Amazon stock. We see greater potential for earnings upside and revaluation for Amazon than for the other mega-cap stocks we cover.”

Sanderson goes on to put a Buy rating on AMZN shares, with a $275 price target that indicates his confidence in a 28% upside for the year ahead. (To watch Sanderson’s track record, click here)

Overall, Amazon has 45 recent analyst reviews, with a lopsided split of 44 Buys to 1 Hold to give the stock a Strong Buy consensus rating. The shares are currently priced at $214.10, and their $238.35 average price target implies a 12-month gain of 11%. (See AMZN stock forecast)

Alphabet

The second stock we’re looking at Alphabet, the parent company of Google. Through Google, and through YouTube, Alphabet is the leader in the internet search niche – a vital niche for any company with one foot in data and one foot in AI. Alphabet’s success in this field has brought the company to the rarefied heights near the top of Wall Street’s ladder – and to a market cap of $2.17 trillion.

Alphabet, like Amazon, has been working hard to keep itself relevant – and that means making use of AI, as both a tool and a product. The company uses AI technology in its search engines, to improve results from both Google and YouTube. This is a key effort, as Google is the net’s largest search engine and YouTube is the largest video search platform. Alphabet is also using AI in its digital advertising work, its key revenue driver. AI tools help to target ads more precisely, and the technology provides translation matrices allowing multimodal large language models – so that Alphabet’s search engines, and its ad work, can interact with users and customers in their native languages.

At the core of Alphabet’s customer-facing AI work is the Gemini platform, the company’s latest iteration of generative AI. Gemini powers the large language models, and can apply them to text, images, audio, and video – and even to computer code. Alphabet is working to integrate the platform into all of its products, including the widespread Android mobile operating system. That latter will connect Gemini with the world of smartphones, and their applications.

This is the key challenge for Alphabet in the coming months and years – bringing AI into its world of products, so that they remain relevant to users and continue to maintain the company’s base asset, its large market share in online search.

Alphabet reported its 3Q24 results at the end of last month. The company’s quarterly revenues came to $88.3 billion, beating the forecast by over $2 billion and growing 15% year-over-year. The company realized earnings of $2.12 per share, a figure that was up 37% y/y and was 27 cents better than the forecast.

When we check in again with Sanderson, we find that the analyst acknowledges Alphabet’s strengths – but also sees it facing a series of challenges in the near-term. Sanderson writes of the Google parent, “We think that management is doing many things right, especially with spending discipline and increasing stock repurchase through this period of longer-term uncertainty and valuation pressure. Besides evidence of revenue growth acceleration driven by AI search (which does not seem likely in the near term), we do not see a catalyst for sentiment reversal. We do however see gen-AI efforts from others that can further elevate concern over search query displacement, namely Meta AI, SearchGPT, Apple Intelligence and Alexa. With what appears to be a promising earnings set-up, any thawing of icy investor sentiment could be a meaningful upside catalyst, but we expect valuation pressure will continue for the foreseeable future.”

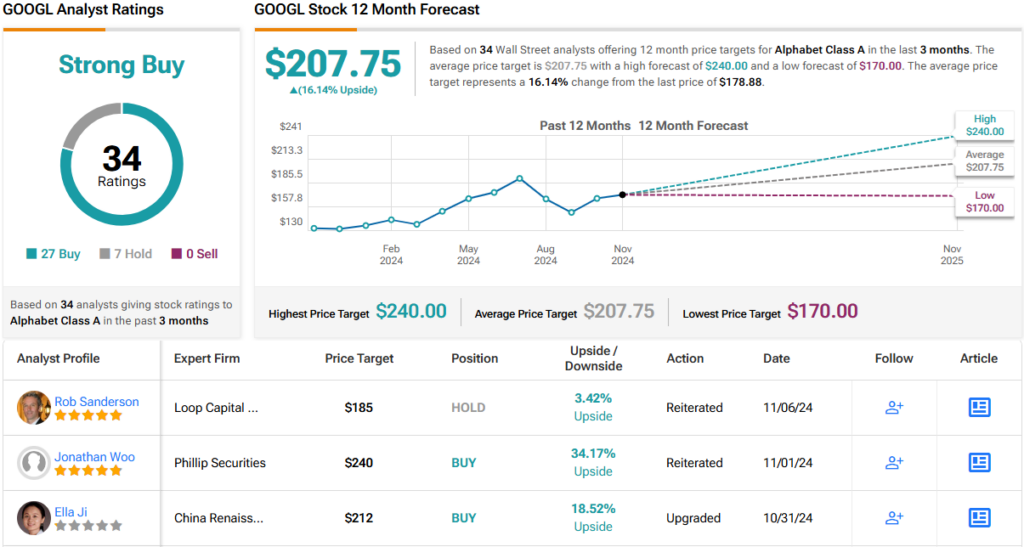

In light of these comments, Sanderson rates GOOGL shares as a Hold (i.e. Neutral), and his price target, of $185, suggests a modest one-year gain of 3.42%.

The Street as a whole is still willing to put a Buy on GOOGL – the stock’s 34 recent share reviews include 27 Buys and 7 Holds for a Strong Buy consensus. The stock has a $207.75 average price target and a $178.88 current share price, together indicating room for upside growth of 17.7% by this time next year. (See GOOGL stock forecast)

Now that we’ve looked at the stocks and at Sanderson’s take on both, it’s clear that the top analyst has selected Amazon as the superior AI stock to buy as 2024 winds down.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.