At its Delivering the Future event, e-commerce giant Amazon (AMZN) unveiled plans for advanced warehouses powered by robots, which will start with a huge facility in Shreveport, Louisiana. This 3-million-square-foot space is spread over five floors and will be roughly the size of 55 football fields. It’s part of Amazon’s decade-long push to integrate robots into its operations, which began with buying Kiva robots in 2012.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Shreveport warehouse will have 10 times more robots than a typical Amazon fulfillment center. A new system called Sequoia will also be used, which can hold over 30 million items and is five times bigger than the version launched last year. Despite all the automation, there will still be human workers at the facility, with plans to employ 2,500 people.

Continuously Improving

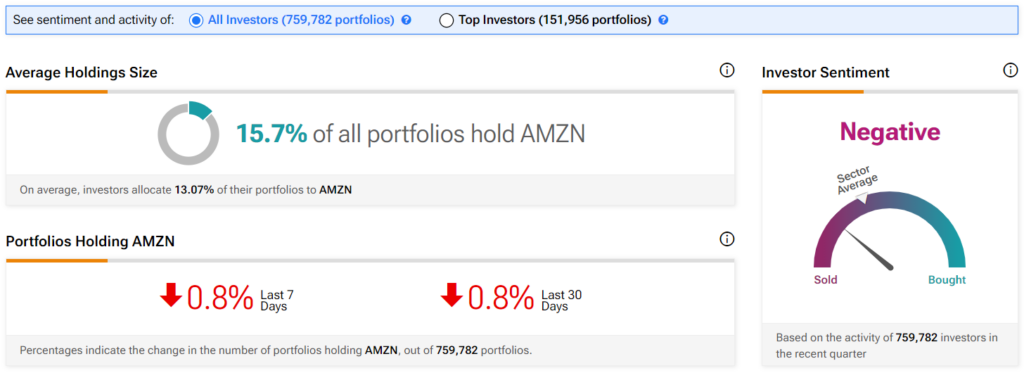

Amazon is continuously working to improve its operations, which was further demonstrated earlier today when it announced that it was expanding same-day prescription drug delivery. This relentless drive to stay ahead of the competition is what led to the firm becoming a trillion-dollar business. Therefore, it is no surprise to see a large chunk of portfolios tracked by TipRanks holding shares of Amazon. More specifically, 15.7% hold AMZN stock with an average portfolio weighting of 13.07%.

However, it is worth noting that investor sentiment has recently turned negative, as 0.8% of investors with a position in the company have reduced their holdings in both the last seven and 30 days.

Is Amazon Stock a Buy?

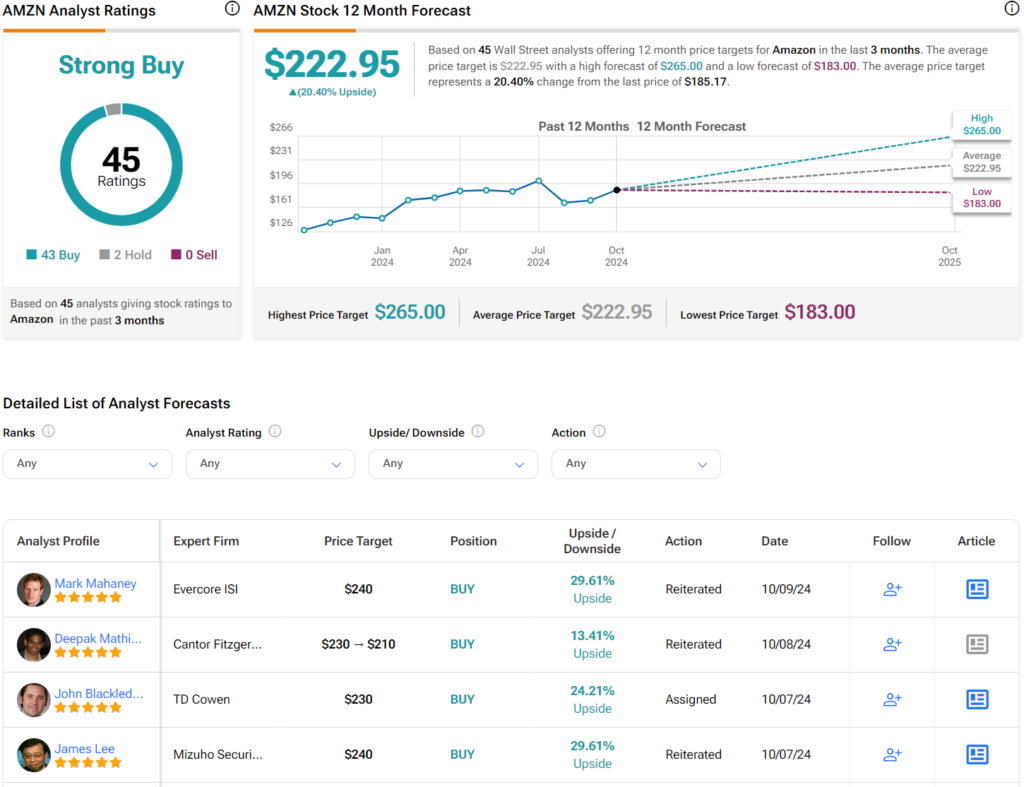

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 43 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 43% rally in its share price over the past year, the average AMZN price target of $222.95 per share implies 20.4% upside potential.