Amazon (AMZN) is the latest technology company to turn to nuclear power to meet its data center electricity needs.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The e-commerce company has signed agreements with privately held X-Energy and several state utilities to develop and draw power from small modular nuclear reactors. Financial terms of the deals were not disclosed, although some media outlets are reporting that Amazon is spending as much as $500 million developing the reactors.

Amazon will eventually have the right to purchase electricity from four nuclear reactors to help power its data centers that run artificial intelligence (AI) applications. In years to come, Amazon could draw power from as many as eight small modular nuclear reactors that, combined, can produce enough power to run nearly 800,000 homes, said the company.

This is Amazon’s latest push into nuclear-generated power. Earlier this year, Amazon purchased a nuclear-powered data center from Talen Energy (TLN). Amazon Web Services (AWS), the company’s cloud computing unit, has a growing need for power as it expands into AI. Amazon has also said that nuclear energy will help to reduce its carbon dioxide emissions.

Tech Companies Go Nuclear

Amazon is not alone in tapping nuclear energy to meet its growing power needs. Several other technology companies are also turning to nuclear power to generate the electricity needed to run AI applications and models.

Google parent company Alphabet (GOOGL) has announced plans to also use small modular nuclear reactors to meet its future power needs. And Microsoft (MSFT) has outlined an ambitious plan to restart a dormant nuclear reactor at Three Mile Island in Pennsylvania to power its AI projects. Investment bank Goldman Sachs (GS) has forecast that U.S. data center power will triple by 2030.

Amazon’s stock has risen 22% so far this year.

Is AMZN Stock a Buy?

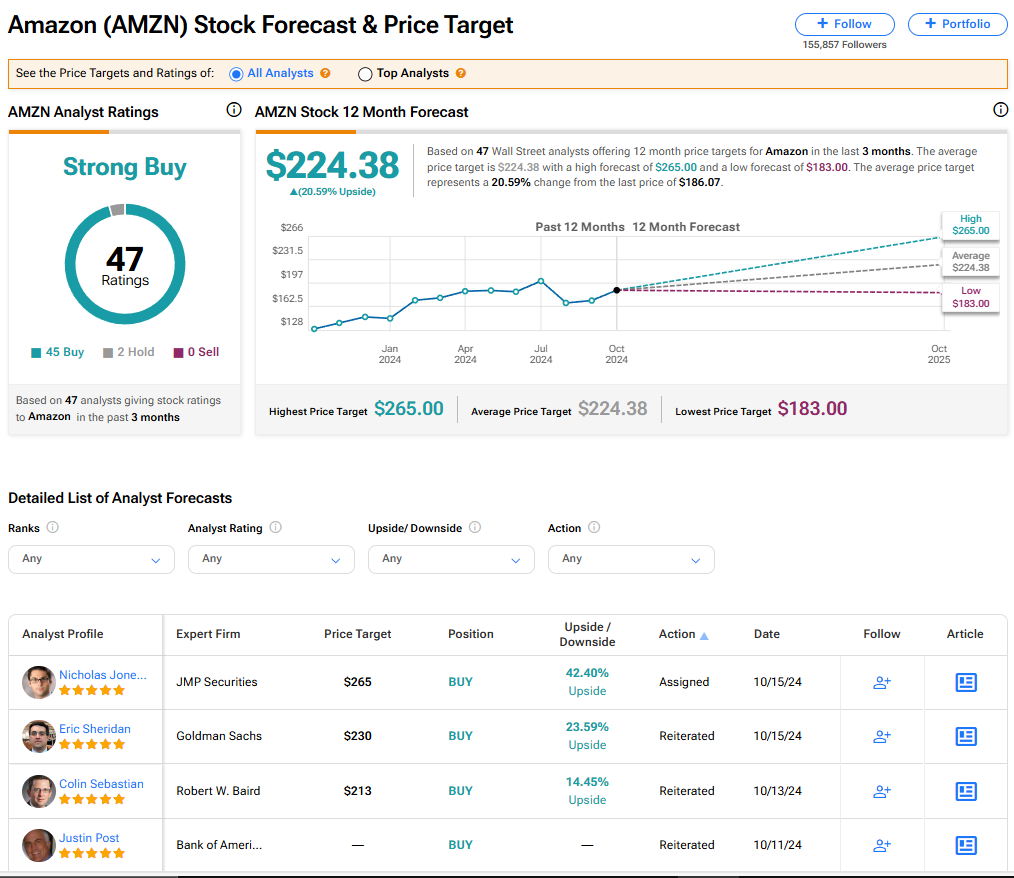

Amazon stock has a consensus Strong Buy rating among 47 Wall Street analysts. That rating is based on 45 Buy and two Hold recommendations issued in the last three months. There are no Sell ratings on the stock. The average AMZN price target of $224.38 implies 20.59% upside from current levels.