Amazon (NASDAQ:AMZN) is planning a complete overhaul of its voice assistant service, Alexa. According to an exclusive report by Reuters, the tech giant plans to include a conversational generative AI with two tiers of service, called “Remarkable Alexa.” The report states that Amazon could potentially charge a monthly fee in the range of $5 to $10 to access the premium tier.

More Details About “Remarkable Alexa”

This project is known internally as “Banyan” and marks the first major update of Alexa since its debut in 2014. The company is pushing for a deadline of August to get the newest version of Alexa ready. An Amazon spokeswoman told Reuters that the company has integrated generative AI into the different components of Alexa and is “working hard on implementation at scale—in the over half a billion ambient, Alexa-enabled devices already in homes around the world.”

Amazon expects that with the AI features of Alexa, its customers will ask for shopping advice from the voice assistant. Other features that the company is working on for Alexa could enable it to compose and send emails and order dinner for delivery.

Why is Alexa Important for Amazon?

Alexa was a pet project of Amazon’s founder, Jeff Bezos, but unfortunately, it has proved to be a loss-making proposition. It did not boost the company’s e-commerce sales as initially hoped. Furthermore, Amazon is on the back foot when it comes to generative AI, as competitors like Google (NASDAQ:GOOGL) have unveiled chatbots that can instantly respond to complicated queries.

As a result, according to Reuters, some Amazon employees have called the “Banyan” project a “desperate attempt” to revive the unprofitable Alexa service. Moreover, the company’s senior management stressed that this year is critical for proving that Alexa can boost sales.

Is Amazon a Buy, Sell, or Hold?

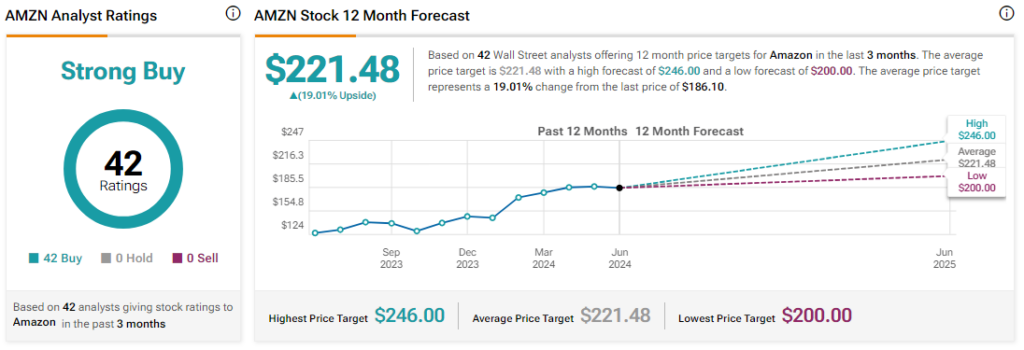

Analysts remain bullish about AMZN stock, with a Strong Buy consensus rating based on a unanimous 42 Buys. Over the past year, AMZN has surged by more than 45%, and the average AMZN price target of $221.48 implies an upside potential of 19% from current levels.