Amazon (AMZN) has announced a new Counterfeit Crimes Unit to combat the proliferation of knockoffs on its store. The team is said to be composed of “former federal prosecutors, experienced investigators, and data analysts,” who will “go on the offensive” against counterfeiters.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

“Every counterfeiter is on notice that they will be held accountable to the maximum extent possible under the law, regardless of where they attempt to sell their counterfeits or where they’re located,” Amazon’s Dharmesh Mehta, VP of Customer Trust and Partner Support said today.

Products that are counterfeit have been a major issue effecting the retail online giant’s own brands and products. Additionally, some companies such as Nike (NKE) have stopped selling directly through Amazon. Third-party sellers peddling knockoffs, unlicensed products, and imposter sellers were cited by Nike as being part of the problem.

Amazon has 8,000 employees working to fight these efforts by spending over $500 million in 2019 to fight customer abuse, fraud, and counterfeit products. Additionally it shut down 6 billion suspected bad listings along with blocking 2.5 million bad actor accounts last year. Highlighting this on its website, Amazon says, “It’s critical that Amazon, brands, and law enforcement also go on the offensive and hold counterfeiters accountable for their crimes.”

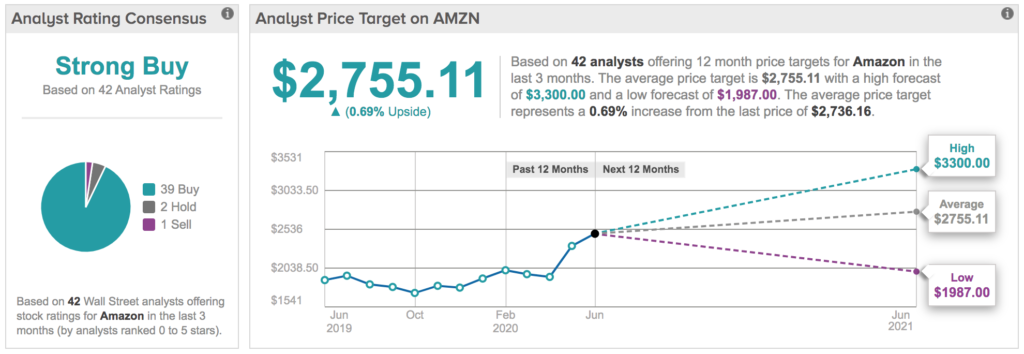

Wedbush analyst Michael Pachter was optimistic on Amazon’s prospects noting that he expects steady margin growth coming out of AWS, Fulfillment by Amazon, and ads, while Prime drives overall revenue growth on the retail side. He sees, “substantial earnings over the long term by growing spending more slowly than revenues.” Pachter raised his price target on Amazon from $2750 to $3050 on June 24 while keeping a Buy rating on the stock. His new price target suggests 12% further growth lies ahead for the coming months.

Likewise, Needham analyst Laura Martin recently reiterated a Buy rating with a price target at $3200, indicating upside potential of 17%. She highlighted the recent valuation boost to Amazon’s popular video game streaming site, Twitch, in light of Microsoft’s (MSFT) decision to shut down its own game streaming version known as Mixer.

The Strong Buy analyst consensus breaks down into 39 Buy ratings versus 2 Hold ratings and 1 Sell rating. The $2755 average price target implies 1% upside potential for the shares in the coming 12 months. (See Amazon’s stock analysis on TipRanks).

Related News:

Lookout Walmart, Amazon Is Coming for Your Grocery Customers, Says Analyst

Slack Seeks To Replace E-mail With Launch Of Virtual Business Platform

Microsoft’s Xbox Closes Mixer Live Streaming, Partners With Facebook Gaming