Online retail giant Amazon.com, Inc. (NASDAQ: AMZN) is ready to acquire iRobot, Inc. (NASDAQ: IRBT), an expert in manufacturing robotic vacuum cleaners. A definitive merger agreement was signed between the parties on Aug 5, 2022, giving hope to Amazon investors that Amazon stock will rise.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of AMZN slipped 1.2% to close at $140.80 on Friday. However, the stock of this $1.4-trillion company inched up 0.6% in Friday’s extended trade. Meanwhile, shares of IRBT jumped 19.1% to close at $59.54 on Friday.

Amazon has agreed to buy iRobot for $61 per share, valuing the Roomba-maker at $1.7 billion. The all-cash transaction would increase the product portfolio of Amazon Devices, enhancing its presence in the home-device market segment.

The completion of the transaction is contingent upon the receipt of regulatory approvals, a go-ahead from iRobot’s shareholders, and the satisfaction of customary closing conditions.

The Chairman and CEO of iRobot, Colin Angle, said, “Amazon shares our passion for building thoughtful innovations that empower people to do more at home, and I cannot think of a better place for our team to continue our mission. I’m hugely excited to be a part of Amazon and to see what we can build together for customers in the years ahead.”

It is worth noting that Colin Angle would continue to be the CEO of iRobot post the completion of the Amazon deal. This deal would be highly beneficial for iRobot’s shareholders, especially considering the value Amazon is offering.

Amazon Stock Commands a Strong Buy

On TipRanks, analysts are unanimously optimistic about the prospects of Amazon and have a Strong buy consensus rating based on 39 Buys and one Hold. AMZN’s average price target of $176.04 mirrors 25.03% upside potential from the current level. This purchase could surely bolster the analysts’ confidence in Amazon’s continued performance.

The optimistic view is driven by the company’s sales surprise of 1.7% in the second quarter of 2022 and revenue forecast of $125-$130 billion in the third quarter.

Analysts Less Confident about iRobot

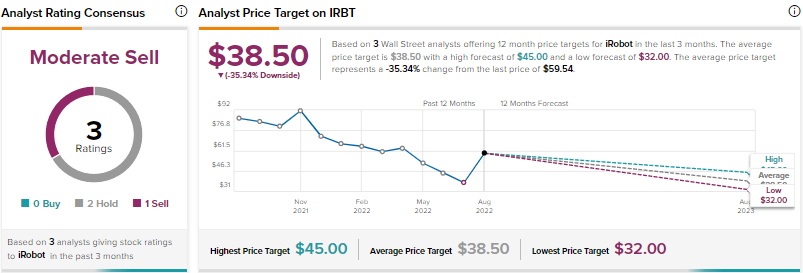

For iRobot, analysts have a Moderate Sell consensus rating based on two Holds and one Sell. IRBT’s average price forecast is $38.50, suggesting a downside risk of 35.34% from current levels.

The company reported narrower-than-expected losses in the second quarter of 2022. However, the loss in the quarter was wider than the year-ago earnings of $0.27 per share. The company has suspended its projections in light of the ongoing Amazon takeover.

Read full Disclosure