E-commerce and cloud giant Amazon (AMZN) is set to increase the number of advertisements displayed on its Prime Video streaming service in 2025, according to the Financial Times. This decision comes after the company first introduced limited ads to Prime Video about eight months ago.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Despite this addition, Amazon has observed that customer churn rates have remained notably lower than anticipated, with fewer than 20% of subscribers opting for the ad-free tier. This positive response to the new advertising model has prompted Amazon to expand its ad strategy.

With this strategic move, the company aims to capitalize on the growing popularity of its streaming service and bolster its advertising revenues. Interestingly, advertising has become a substantial revenue driver for Amazon, with digital ad revenue surging by 20% year-over-year in the second quarter of 2024 to reach $12.8 billion.

AMZN to Introduce Interactive Ads

It is worth highlighting that Amazon plans to enhance its Prime Video ads by introducing interactive features that enable viewers to shop directly from the ads. Using their remote controls or mobile devices, viewers can easily add featured products to their Amazon carts.

This approach is expected to enhance viewer engagement and provide advertisers with new opportunities to connect with their target audience.

Apart from advertising, Amazon is also investing in expanding its Prime Video content library. The company plans to offer live news coverage of the U.S. election and continue its focus on sports and events like the National Football League’s Thursday Night Football and music.

Is AMZN a Good Stock to Buy?

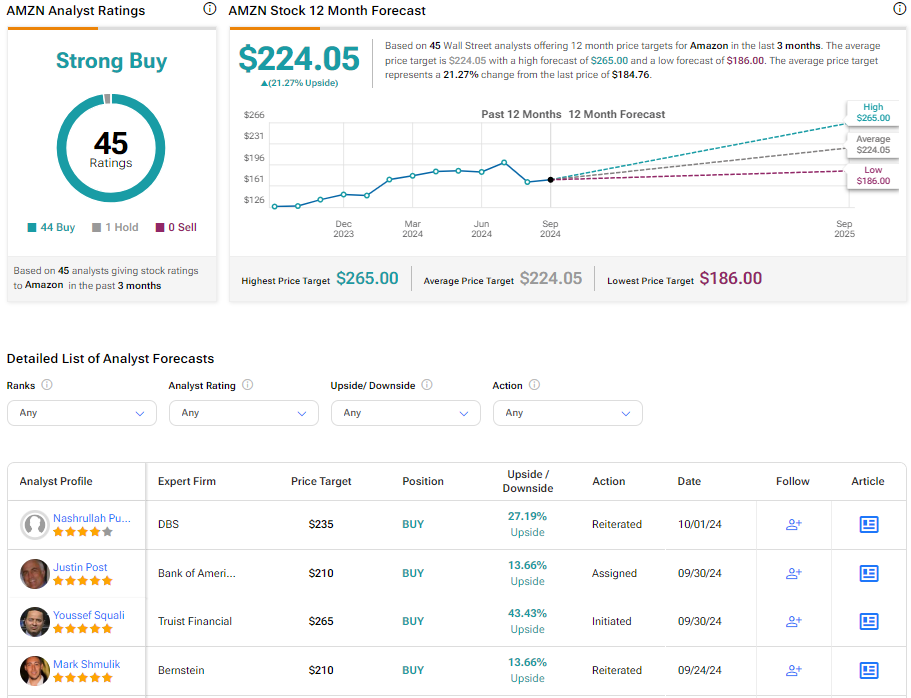

Turning to Wall Street, AMZN stock has a Strong Buy consensus rating based on 44 Buys and one Hold assigned in the last three months. At $224.05, the average Amazon price target implies a 21.27% upside potential. Shares of the company have gained 21.6% year-to-date.