Tobacco giants Altria and Philip Morris have been under pressure over the recent years due to a secular decline in cigarette volumes. This decline has been triggered by many factors like rising awareness about health risks, stricter regulations and the emergence of alternatives like e-cigarettes. Yet, many investors prefer these companies for their high dividend yields.

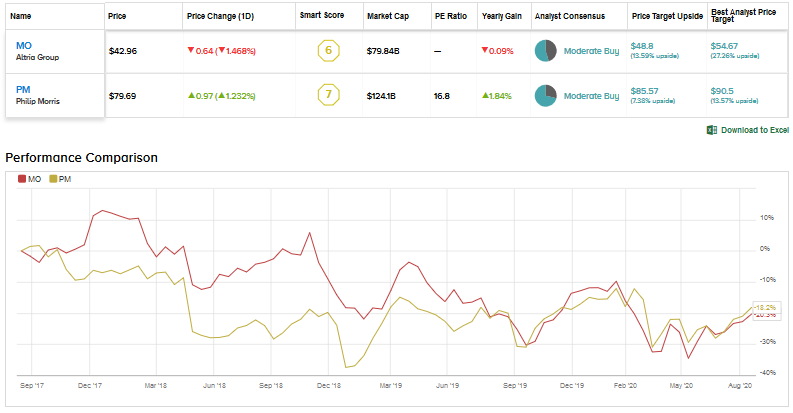

Using the TipRanks’ Stock Comparison tool, we will compare these two consumer staples to see which stock offers the most compelling investment opportunity.

Altria (MO)

Altria, which owns the popular Marlbaro brand in US, has been struggling due to its strategic investments in cannabis company Cronos Group and e-cigarette company Juul. Altria recorded impairment charges related to holdings in both the companies in the recent quarters, including a $4.1 billion charge in 2019’s fourth quarter.

Juul was under fire from the FDA (Food and Drug Administration) and other regulators as well as several US states following vaping-related illnesses and deaths.

Altri’s second-quarter revenue declined 3.8% to $6.37 billion due to lower sales of smokable products and the impact of restaurant and bar closures during lockdowns on its wine business. Despite a fall in revenue, adjusted EPS grew 0.9% to $1.09.

Altria showed resilience in volatile conditions which reflects in the 3.9% revenue growth and an 8.5% rise in adjusted EPS in the first half of this year. Following the second-quarter results, it re-established its adjusted 2020 EPS growth guidance in the 0% to 4% range based on more clarity on the adult tobacco purchase trends and an additional quarter of earnings contributions from Anheuser-Busch InBev.

The company is now looking for expansion in the IQOS market after the US FDA authorized IQOS and HeatSticks to be marketed as Modified Risk Tobacco Products with a “reduced exposure” claim. IQOS is a “heat not burn” device considered as an alternative to conventional cigarettes.

It also has an exclusive agreement with Philip Morris International to sell IQOS in the US- and is eyeing growth in the non-combustible space with Helix Innovation’s on! products, which are currently under review by the FDA.

Several companies have suspended dividends due to the impact of the pandemic on their businesses. However, Altria increased its quarterly dividend by 2.4% to $0.86, marking its 55th dividend increase in the past 51 years.

Following the recent results, Merrill Lynch analyst Lisa Lewandowski reaffirmed a Buy rating for Altria stock with a price target of $50. Lisa Lewandowski stated, “MO offers earnings stability, an attractive yield and a valuation near historical lows.” (See Altria stock analysis on TipRanks)

Based on 6 Buys and 5 Holds, Altria stock has a cautiously optimistic Moderate Buy rating. An average price target of $48.80 implies an upside potential of about 13.6% over the next 12-months.

Philip Morris International (PM)

Philip Morris believes that cigarette sales could end in many countries in the next 10 to 15 years as consumers look for safer alternatives. The company has been focusing on capturing the demand for heated tobacco products and its IQOS tobacco heating device.

As per the company, there were 15.4 million IQOS users as the end of the second quarter, up from 14.6 million a year back. It is also seeing strong momentum for IQOS in Japan, the EU region, and Russia.

Currently, the company’s RRPs or reduced-risk products account for about 25% of its revenue. Philip Morris is targeting 90 billion to 100 billion shipments of heated tobacco units by 2021. The recent authorization of IQOS as a modified risk tobacco product by the US FDA is a very favorable development for the tobacco giant.

Philip Morris’ second-quarter revenue declined 13.6% year-over-year to $6.65 billion as higher volumes of heated tobacco units were partially offset by a decline in cigarette shipments. Adjusted EPS of $1.29 reflected an 11.6% fall. Overall, revenue declined 4.5% and adjusted EPS was down 2.0% in the first half of 2020. Philip Morris foresees its 2020 EPS growth (excluding currency impacts) in the 2% to 5% range.

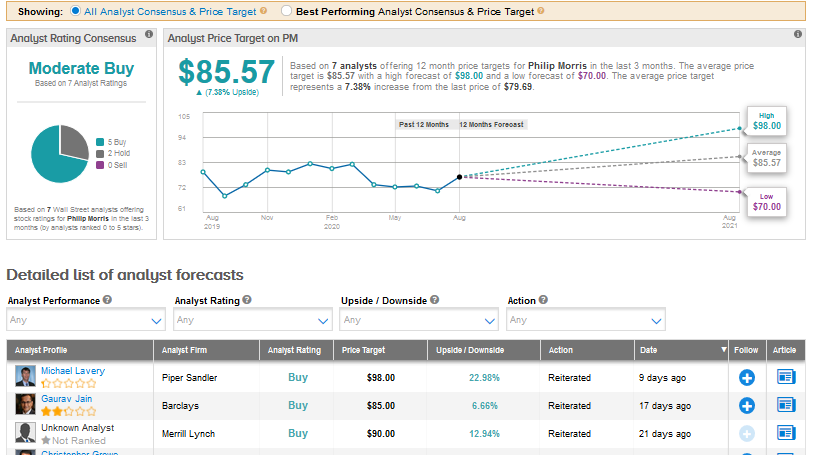

After the recent results, Stifel analyst Christopher Growe maintained a Buy rating for Philip Morris stock while raising the price target to $90 from $85. Growe also upped his 2020 and 2021 estimates backed by “stronger IQOS growth, robust cost savings, and more efficient IQOS spending alongside a continued recovery in volume.” (See Philip Morris stock analysis on TipRanks)

The Street has a Moderate Buy consensus rating for Philip Morris stock with 5 Buys and 2 Holds. An average price target of $85.57 indicates an upside of 7.38% over the next year.

Altria stock has declined 14% year-to-date while Philip Morris was down 6.5% as of August 13. Currently, Altria has a higher dividend yield of 8.0% compared to 6.0% for Philip Morris. Headwinds like regulatory pressure, decline in cigarette volumes, and the impact of travel restrictions due to COVID-19 on duty-free sales continue to concern both Altria and Philip Morris.

However, considering the potential upside over the next 12-months and the higher dividend yield, Altria looks to be a better buy.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment