Tech giant Alphabet’s (NASDAQ:GOOGL) subsidiary Google is facing several antitrust lawsuits. The latest one is by Fortnite creator Epic Games, the hearing of which begins today. Epic Games is suing Google for using its monopolistic power to keep competing app stores out of the game and compelling app makers to pay higher fees for using Google’s in-house payment system. Alphabet CEO Sundar Pichai and Epic Games CEO Tim Sweeney are expected to go on the stand to testify during the trial.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

On November 6, Epic Games will appear in federal court in San Francisco and begin its month-long trial against Apple. The video game creator is citing the violation of both state and federal antitrust laws in the case. Plus, Epic alleges that Google has thwarted competition by bribing some developers to continue using only Google’s own payment system. In the meantime, Google has also counter-sued Epic Games, seeking damages.

The case comes at the same time when Google is facing one of the most high-profile antitrust cases ever with the Department of Justice (DOJ). This ongoing case could help Epic Games have an edge in the fight against Google, while it lost a similar case in 2021 with Apple’s (NASDAQ:AAPL) App Store. Meanwhile, last week, Google settled a similar case with Tinder-owner Match Group (NASDAQ:MTCH). By March 31, 2024, Match’s apps will start using Google’s User Choice Billing, allowing Match Group to use cheaper payment systems other than Google.

Is it a Good Time to Buy GOOGL Stock?

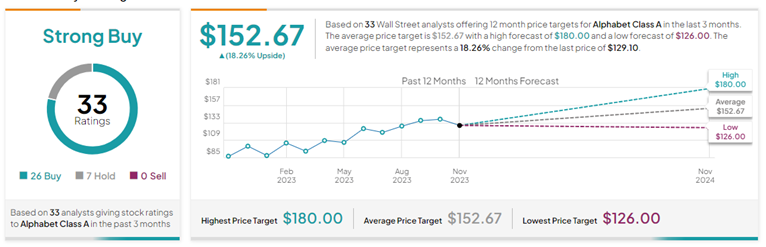

Despite the challenges, GOOGL stock still remains a long-time favorite of Wall Street analysts. On TipRanks, GOOGL has a Strong Buy consensus rating based on 26 Buys and seven Hold ratings. The average Alphabet Class A price forecast of $152.67 implies 18.3% upside potential from current levels. Year-to-date, GOOGL stock has gained 44.9%.