Alphabet’s (NASDAQ:GOOGL) Google has suffered a defeat in an antitrust lawsuit filed by video game developer Epic Games. The lawsuit alleges that Google used its dominant position in the Android app market to stifle competition. Also, Epic accused the company of generating excessive profits by charging app developers commissions ranging from 15% to 30% through its Play Store.

Epic filed the lawsuit in 2020 following the removal of its popular game Fortnite from the Play Store. At that time, Epic encouraged Fortnite players to directly purchase in-game items through Epic rather than via Google’s payment system.

U.S. District Judge James Donato is yet to determine what remedies Epic will receive in the landmark antitrust lawsuit. The parties will reconvene in January to discuss the potential solutions. Epic indicated that it does not seek monetary damages or preferential treatment from Google but aims for a more open and competitive Android ecosystem.

Accusations in Detail

Epic claims that Google entered into agreements with mobile device manufacturers, including Samsung and LG. These manufacturers agreed to pre-install a bundle of Google applications and place them on their home screens. In exchange for this preferential treatment, Epic alleges that Google compensated these manufacturers with a share of its profits.

Furthermore, Epic stated that Google paid off phone carriers like AT&T (T) and T-Mobile (TMUS) and game developers like Activision Blizzard to prevent them from launching competing app stores that could challenge the dominance of the Play Store.

The decision constitutes the first major antitrust defeat for Google. This verdict adds to the company’s existing legal challenges stemming from its dominant position within the search engine market. It is worth mentioning that Google continues to face one of the most high-profile antitrust cases ever brought forth by the Department of Justice (DOJ).

What is the Price Target for GOOGL Stock?

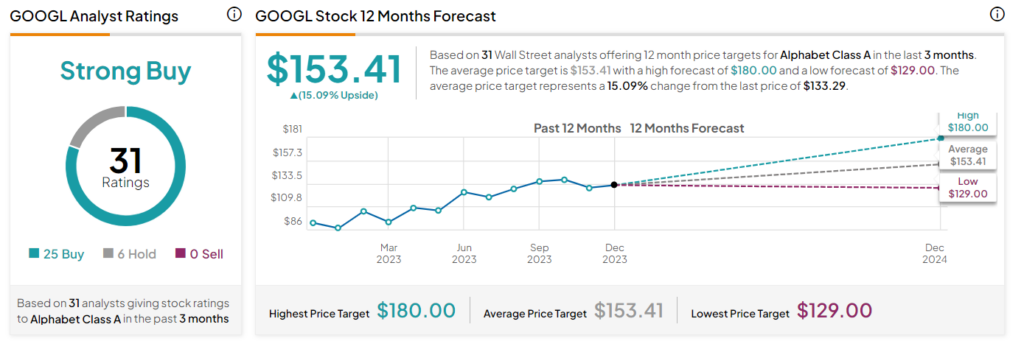

Despite the legal challenges, Wall Street is highly optimistic about Alphabet stock. It has a Strong Buy consensus rating based on 25 Buys and six Holds. The average GOOGL stock price target of $153.41 implies 15.1% upside potential. Shares have gained nearly 50% year-to-date.