Alphabet’s (NASDAQ:GOOGL) subsidiary, Google, has agreed to pay $700 million to settle an antitrust lawsuit filed in 2021 by all 50 U.S. states, along with the District of Columbia, Puerto Rico, and the Virgin Islands. The lawsuit accuses the tech giant of using unlawful restrictions on app distribution and imposing exorbitant fees for in-app transactions to suppress competition on its Android app store, Google Play.

Settlement Terms

Out of the total penalty amount, $630 million will be allocated to a settlement fund to benefit consumers, while the remaining $70 million will be deposited into a fund used by the states. In addition to the penalty, the company has agreed to make slight changes to its app store.

Regarding this, the company will provide an alternative billing system for in-app purchases. Moreover, Google will be allowing direct downloads of apps from developers’ websites in place of using Google Play or other online stores.

Interestingly, the settlement was reached in September 2023. However, Google kept the terms under wraps until it lost a related case to the video game developer, Epic Games, last week.

While the final approval of the judge is still awaited, let’s take a closer look at Alphabet’s legal risks.

GOOGL’s Risk Analysis

Of late, Alphabet is facing mounting legal challenges and scrutiny over its market dominance. It is worth mentioning that Google continues to face one of the most high-profile antitrust cases ever brought forth by the Department of Justice (DOJ).

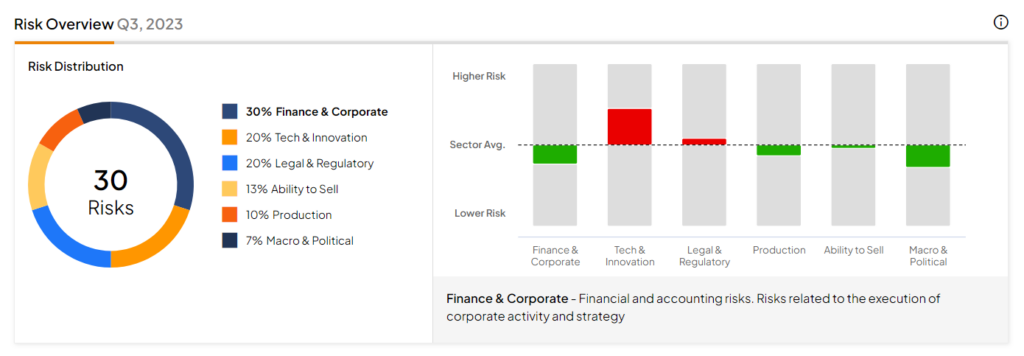

The TipRanks’ Risk Analysis tool shows that Alphabet’s legal and regulatory risks account for 20% of its total risks, which is higher than the industry average of 18.5%.

Is it a Good Time to Buy GOOGL?

Despite the regulatory hurdles, Wall Street is optimistic about Alphabet stock. It has a Strong Buy consensus rating based on 26 Buys and six Holds. The average GOOGL stock price target of $153.97 implies 13.4% upside potential. Shares have gained nearly 52% year-to-date.

Questions or Comments about the article? Write to editor@tipranks.com