Alphabet’s (GOOG) signed a $250 million deal with Taiwan’s HTC (HTCKF) to expand its presence in XR (extended reality) technology. The deal comes after Google launched its Android XR platform in December, in collaboration with Samsung Electronics (SSNLF) and Qualcomm (QCOM). Experts suggest that this acquisition demonstrates Google’s long-term commitment to the Android XR platform.

Notably, XR is a broad term that covers augmented reality (AR), virtual reality (VR), mixed reality (MR), and other similar technologies.

Google Boosts XR Tech with HTC

As part of this deal, Google will buy a segment of HTC’s XR division for $250 million in cash, strengthening its efforts in virtual and augmented reality hardware. It also includes the transfer of VIVE (HTC’s virtual reality platform) engineers to Google and grants Google non-exclusive IP (intellectual property) rights. Meanwhile HTC keeps its rights to use and develop the technology.

This deal is the second major agreement between the companies, following Google’s $1.1 billion acquisition of HTC’s smartphone unit in 2017.

Android XR: Exploring the Potential of Mixed Reality

The acquisition aligns with Google’s development of the Android XR platform for headsets and smart glasses. The platform integrates the Gemini assistant, and various Google apps like Maps, Chrome, and YouTube, and supports multiple virtual screens. Meanwhile, Samsung’s ‘Project Moohan’ headset will be the first product under Android XR, expected to launch later this year. These headsets will directly compete with Meta’s (META) Orion smart glasses and Apple’s (AAPL) Vision Pro headset.

Google said this deal will speed up Android XR development for headsets and glasses, boosting its position in the VR race with Apple and Meta.

Are Google Shares a Good Buy?

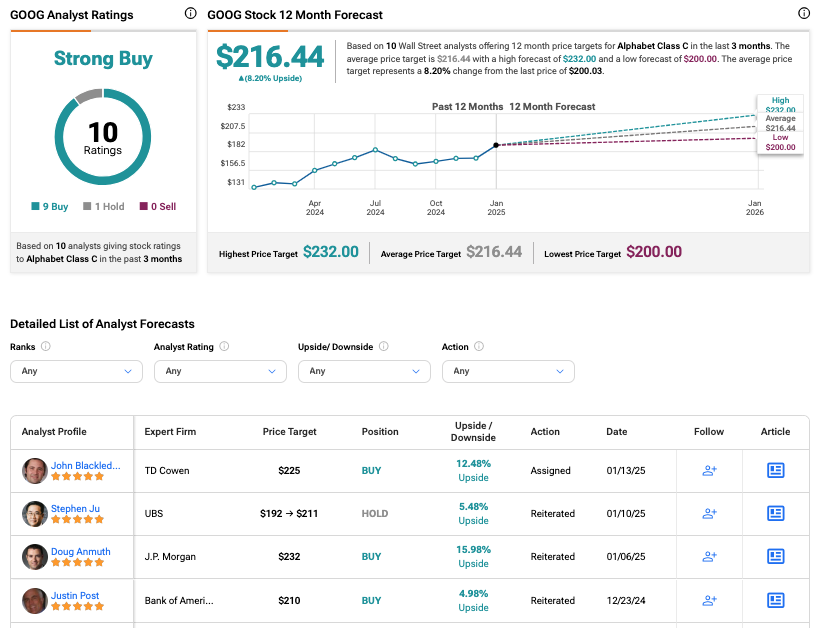

On Wall Street, analysts remain highly optimistic about GOOG stock. TipRanks consensus gives it a Strong Buy rating, based on nine Buy and one Hold recommendations. The Alphabet share price target of $216.44 suggests a 8.2% upside from current levels.