Shares in Alphabet (GOOGL) rose 7.6% in Thursday’s after-hours trading, despite the company posting its first-ever revenue decline.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Nonetheless, earnings beat consensus estimates with Q2 GAAP EPS of $10.13 beating by $1.94. Meanwhile revenue of $38.29B dropped -1.7% year-over-year, but still beat Street estimates by $950M.

“In the second quarter our total revenues were $38.3B, driven by gradual improvement in our ads business and strong growth in Google Cloud and Other Revenues,” commented Ruth Porat, CFO of Alphabet and Google. “We continue to navigate through a difficult global economic environment.”

Search Revenue declined 10% Y/Y (vs 9% year-over-year growth in Q1), while YouTube Ads Revenue grew 6% year-over-year in Q2 vs 33% in Q1. However, Search Revenue recovered to flat year-over-year at the end of June, with signs of continued modest recovery in July.

As for Google Cloud, it delivered $3B in revenue, up 43% year-over-year vs 52% in Q1, with the deceleration partially reflecting the G-Suite price increase last April. Meanwhile TAC (traffic acquisition cost) came in at $6.69B just higher than consensus of $6.67B alongside operating margin of 17% (vs. 15.7% consensus) and Capex of $5.39B (vs $5.42B consensus).

Alphabet had ~$13.5B of its prior buyback authorization remaining at the end of 1Q20 and repurchased $6.9B of shares though 2Q quarter. However, the Board has now approved an additional $28B implying it now has a $34.6B authorization available to support the stock if headwinds arise.

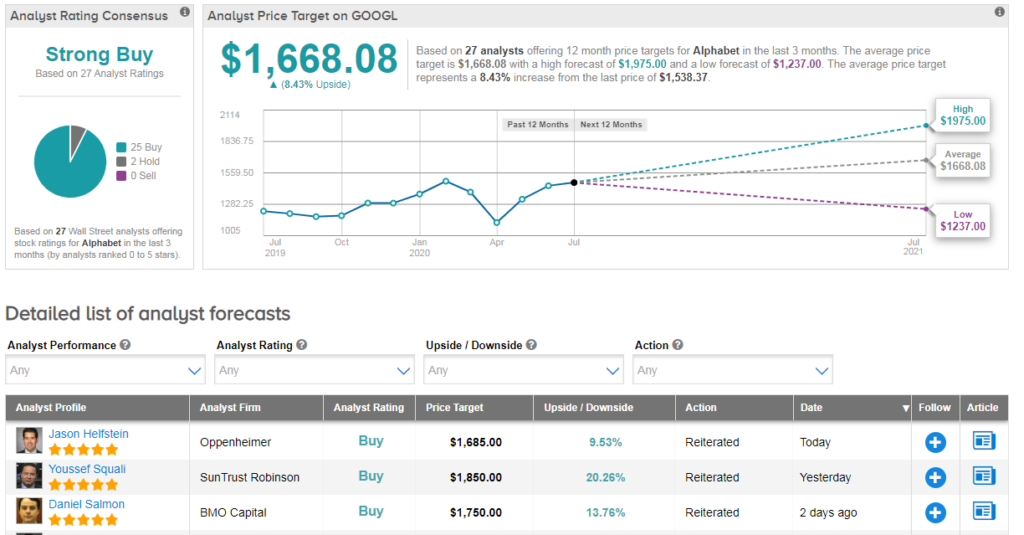

Following the report, RBC Capital analyst Mark Mahaney reiterated his buy rating while ramping up the price target from $1,500 to $1,700.

“Despite a slightly elongated recovery curve, we continue to see GOOGL (along with AMZN and FB) as among the most resilient ’Net Advertisers” he commented. “Fundamentals are slowly but surely improving, and aggressive share repo continues. We model 8% Gross Revenue growth in Q3 with growth rate close to normalized by Q4 at 15%” the analyst concluded.

Similarly, Youssef Squali reiterated his buy rating while boosting his price target from $1,805 to $1,850. “Google continues to be an attractive story at a compelling valuation in our view, despite posting its first ever revenue decline, as trends exiting 2Q and into 3Q suggest an improving demand environment” the analyst explained.

While macro uncertainty remains, the pandemic has proven to be a major accelerant to several digitization trends, which Google stands to benefit from long-term, Squali concludes.

Overall, Alphabet scores a bullish Strong Buy Street consensus with a $1,668 average analyst price target (8% upside potential). Shares in GOOGL are up 15% year-to-date. (See Alphabet stock analysis on TipRanks).

Related News:

Facebook Soars 6% After-Hours On Strong Beat, Ad Resilience

Amazon Rises 5% As ‘King Of E-Commerce Shines Amidst The Pandemic’

Shopify Soars 10% On Earnings Beat

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue