Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) is bringing its much-awaited Google News Showcase to the United States this summer, following its launch in 2020. Google News Showcase will allow media outlets to publish their content on the platform and receive compensation in return. This is part of a global effort that aims to help publications earn some money from technology companies.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The Google News Showcase will feature roughly 150 U.S. news publications from across 39 states. These include large and well-known outlets such as Bloomberg and The Wall Street Journal, as well as smaller region-specific counterparts. The terms of the compensation remain unknown, but the launch of Google News Showcase in the U.S. was paused for a long time due to prolonged negotiations between media outlets and Google regarding payment terms.

New Laws to Promote Media-Tech Partnerships

News Corp. (NASDAQ:NWSA) and The New York Times (NYSE:NYT) have already signed deals with Google News Showcase, which would generate roughly $100 million in revenue a year. Media companies have been struggling to earn ad dollars with the stiff competition, and with the rise of tech companies as digital advertising hubs, gaining viewership has become even more difficult for traditional outlets. Consequently, legislators around the globe are endeavoring to compel technology companies to compensate media outlets for featuring their content in their products.

Since its launch, Google News Showcase has signed over 2,300 news outlets worldwide and has spread to 22 countries. The gist of the news story is highlighted on Google News and Discover, allowing readers to click on the story for a more comprehensive read and leading them directly to the publication’s main page. This helps strengthen the relationship between the news outlet and its readers and gives the publication scope to leverage its brands.

Is Google a Good Long-Term Investment?

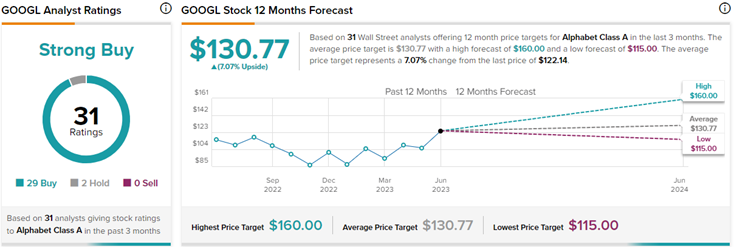

On June 8, Wells Fargo analyst Ken Gawrelski initiated coverage of GOOGL stock and assigned a Hold rating to the stock. The analyst set a price target of $117, implying 4.2% downside potential from current levels.

Wall Street analysts have a highly bullish view of Alphabet stock. On TipRanks, GOOGL commands a Strong Buy consensus rating based on 29 Buys and two Hold ratings. The average Alphabet price target of $130.77 implies 7.1% upside potential from current levels. Meanwhile, GOOGL stock has gained 37.1% year-to-date.