Alphabet (GOOGL) is gearing up to release its third-quarter 2024 earnings on October 29. Wall Street analysts are forecasting growth in both revenue and earnings, suggesting strong near-term performance for GOOGL. The analysts expect the company to report earnings per share of $1.84, an 18% year-over-year increase. Revenue is also expected to climb 13% from the same period last year, reaching $86 billion, according to data from the TipRanks Forecast page.

As we approach Q3, it’s important to highlight that Alphabet has surpassed the consensus EPS estimates in the past six consecutive quarters.

Key Takeaways from TipRanks’ Bulls & Bears Tool

TipRanks Bulls Say, Bears Say tool provides insights into analysts’ views of Alphabet as the company nears its Q3 earnings report. The bulls are optimistic about Alphabet’s growth potential, highlighting the increased monetization possibilities from integrating generative AI into its search cloud. They also note that Google Cloud is forecasted to grow by 30%, underscoring its momentum in the cloud sector. Meanwhile, Alphabet’s strategic position in digital advertising enables it to leverage current market trends, establish a lasting cloud business, and drive AI-driven innovation across its operations.

On the flip side, bears are cautious about Alphabet’s financial outlook, citing risks to Q4 and next year’s operating income and EPS due to rising capital expenditures. Competition also poses a challenge, with YouTube under pressure from Amazon’s (AMZN) Prime Video and Netflix (NFLX). Also, regulatory concerns persist as Google faces antitrust violations over its search and text advertising dominance, potentially impacting its market position and growth.

Options Traders Anticipate a 6.40% Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting a 6.40% swing in either direction.

Is Alphabet Stock a Good Buy?

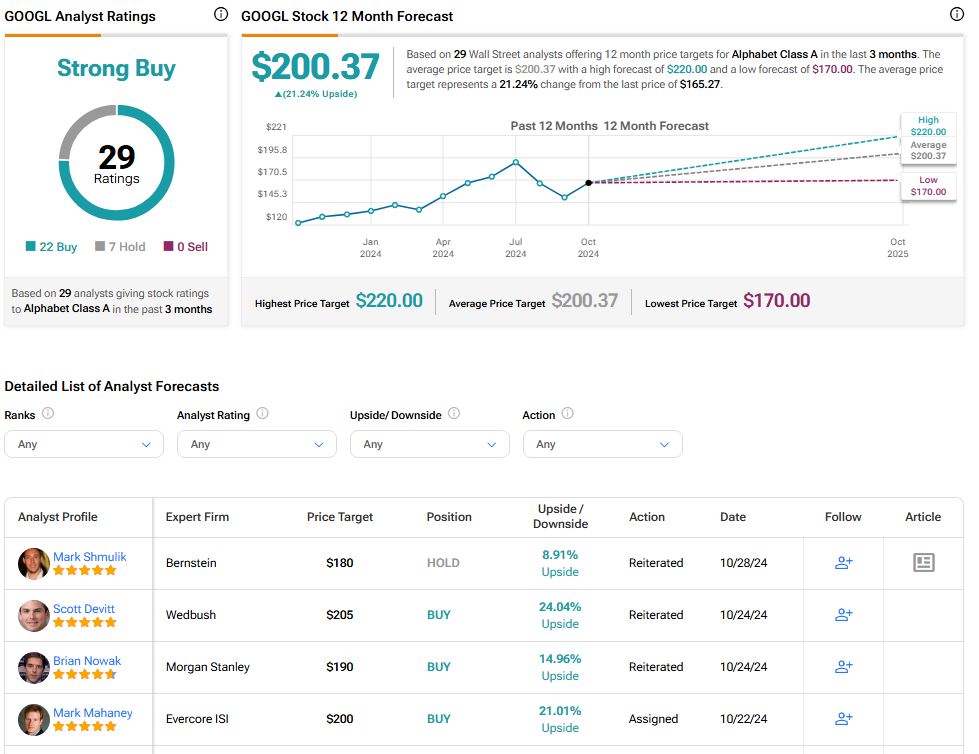

Turning to Wall Street, Alphabet stock has a Hold consensus rating based on 22 Buys and seven Holds assigned in the last three months. At $200.37, the average GOOGL price target implies 21.24% upside potential.