Shares of Google’s parent company, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), fell over 5% in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $1.55, which beat analysts’ consensus estimate of $1.45 per share.

Sales increased by $11.1% year-over-year, with revenue hitting $76.79 billion. This beat analysts’ expectations by $980 million. $59.6 billion of Q3 sales came from advertising, of which $44 billion came from its Google Search division, while $8 billion came from YouTube.

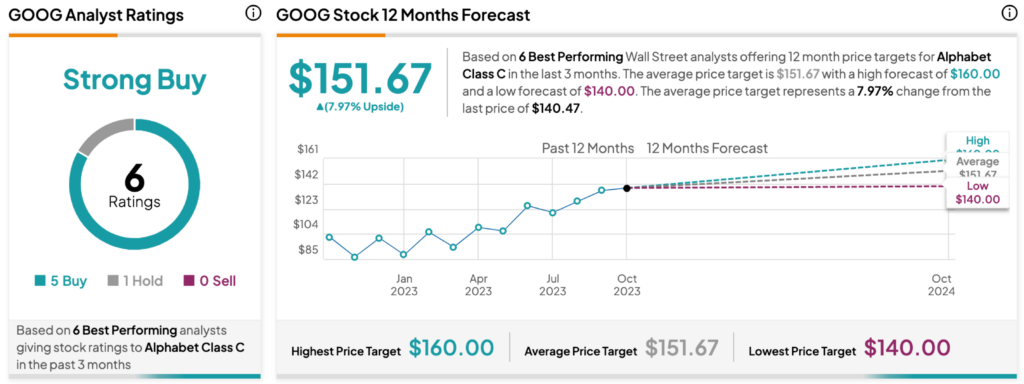

What is the Price Target for GOOG?

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOG stock based on five Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average GOOG price target of $151.67 per share implies 7.97% upside potential.