The Allstate Corporation (NYSE: ALL) reported upbeat fourth-quarter 2021 results. Strong revenues and strategic actions drove results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Quarterly Results in Detail

Allstate reported adjusted earnings of $2.75 per share, which comfortably beat the consensus estimate of $2.70 per share but fell 46.9% year-over-year. Adjusted net income plummeted 50% to $796 million.

On the positive side, total revenues of $13 billion grew 18.7% year-over-year and topped analysts’ expectations of $10 billion. Elevated auto insurance market share, higher investment income, and growth in Protection Plans were the main drivers of revenue.

Property-Liability written premium stood at $10.3 billion, up 19.7% year-over-year. Additionally, Protection Services revenues grew 21.9% to $606 million.

Also, Allstate Health and Benefits premiums and contract charges jumped 75.2% to $459 million, mainly due to the addition of group and individual health businesses acquired with National General.

Net investment income came in at $847 million, up 28.3% year-over-year.

Full-Year 2021 Results

For 2021, the company reported adjusted earnings of $13.48 per share, down 5.7% year-over-year. Adjusted net income decreased 10.6% to $4 billion. Meanwhile, revenues grew 20.7% to $50.6 billion.

Advanced with its Transformative Growth initiatives in 2021, Allstate recorded 190.9 million consolidated policies in force, up 9.8% year-over-year.

Capital Deployment

In 2021, Allstate returned $4.1 billion to common shareholders through $3.3 billion in share repurchases and $885 million in shareholder dividends.

Official Comments

Sharing his thoughts, Allstate’s CFO Mario Rizzo said, “Allstate’s earnings power and proactive capital management support reinvestment in growth and provided excellent cash returns to shareholders. We closed on the acquisitions of National General for $4 billion and SafeAuto for $262 million in 2021, enhancing our competitive position in personal lines insurance and further increasing market share.”

Wall Street’s Take

Following the Allstate earnings report, Wells Fargo analyst Elyse Greenspan maintained a Sell rating and a price target of $105 (10.78% downside potential).

Greenspan expects “ALL shares to trade down tomorrow owing to the weaker auto margin, which should bring down forward numbers.”

Overall, the stock has a Hold consensus rating based on 2 Buys, 5 Holds, and 2 Sells. The average Allstate price target of $125.13 implies 6.32% upside potential. Shares have jumped 11.8% over the past year.

Risk Analysis

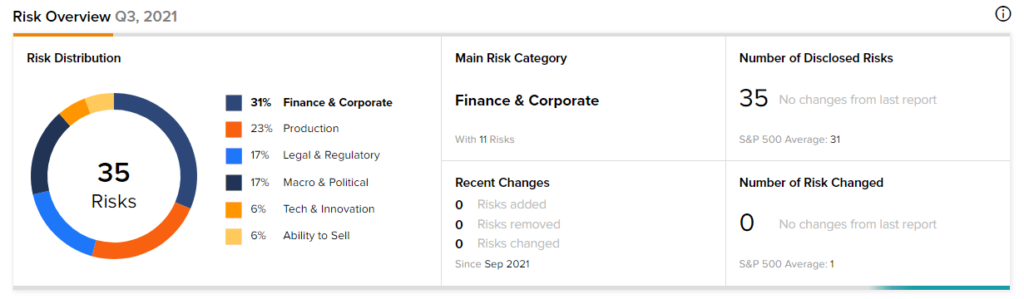

According to the new TipRanks’ Risk Factors tool, Allstate stock is at risk mainly from three factors: Finance and Corporate, Production, and Legal & Regulatory, which contribute 31%, 23%, and 17%, respectively, to the total 35 risks identified for the stock.

At 11 financial risks, Allstate is at considerably lower risk financially than other companies in its industry. Given its lower-risk profile and strong numbers, investors might consider adding Allstate to their baskets.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

ExxonMobil, Targeting Reduced Costs, Restructures Business Units

Ford to Accelerate Investments by $20B in EV Push?

Alphabet: Upbeat Q4 Results; 20-for-1 Stock Split in the Works