Insurance company The Allstate Corporation (ALL) recently announced that it has concluded the sale of Allstate Life Insurance Company of New York to Wilton Re for $400 million.

Following the news, shares of the company gained marginally to close at $127.72 on Friday.

In a separate deal announced earlier this year, the company agreed to sell Allstate Life Insurance Company to Everlake US Holdings Company. The financial terms of the sale have been kept under wraps. The deal is likely to close this year.

The CFO of Allstate, Mario Rizzo, said, “Closing on the sale of ALNY is a significant step in Allstate’s strategy of increasing personal property-liability market share and expanding protection services, while deploying capital out of the life and annuity businesses.” (See Allstate stock chart on TipRanks)

Last month, Raymond James analyst Charles Peters reiterated a Buy rating on the stock with a price target of $150, which implies upside potential of 17.4% from current levels.

The analyst said, “ALL’s recent results reflect a near-term position of strength considering their CR of 86.4% last quarter compared with others like KMPR’s 116.4%, MCY’s 94.9% and PGR’s 96.5%. On a longer-term basis, we believe ALL will have transformed into a 15%-20% annual ROE company from its previous target of 14-17%. ALL currently trades at 1.5x recent book value with a 2022E ROE of 14% compared with the auto peer average of 1.7x recent book value with an average 10% ROE. ALL is our top pick in personal lines insurance.”

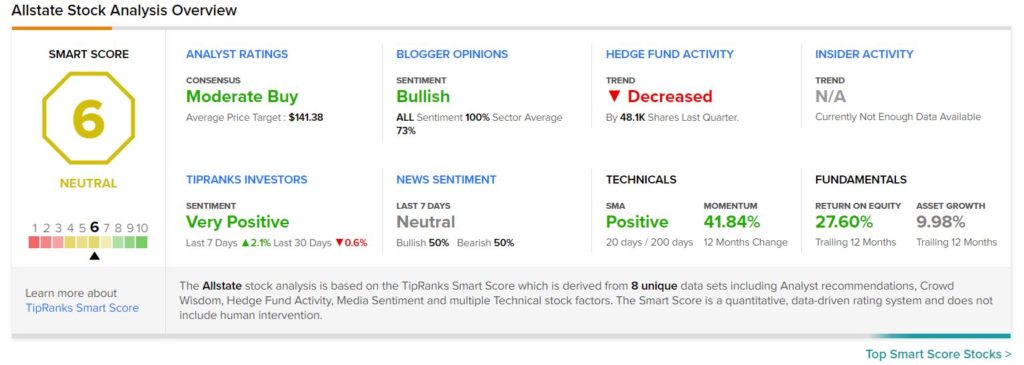

Consensus among analysts is a Strong Buy based on 3 Buys and 5 Holds. The average Allstate price target of $141.38 implies upside potential of 10.7% from current levels.

Allstate scores a 6 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market expectations. Shares of the company have gained 86.6% over the past year.

Related News:

ING Groep Unveils €1.7B Share Buyback Program

Bed Bath & Beyond Crashes 22% on Disappointing Q2 Results

Merck to Acquire Acceleron Pharma for $11.5B