Semiconductor and equipment maker Allegro MicroSystems (ALGM) has seen a surge in momentum, with wins coming from major automotive and industrial markets. The company recently introduced two new XtremeSense TMR current sensors, high-bandwidth products crucial for power density designs, contributing to space, cost savings, and enhanced energy efficiency. Meanwhile, Allegro has also recently debuted its innovative power products at Electronica 2024, which is set to redefine power and efficiency across automotive, industrial, and data center applications.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

These advances in power electronics technology mark the dawn of a new era in Allegro’s journey. The company posted solid Q2 performance, and while a decline is anticipated in the next quarter on softness in demand from the China EV market, the long-term outlook is optimistic, making it a stock investors may want to keep an eye on.

Allegro Microsystems’ Operations

Allegro Microsystems specializes in designing, developing, and marketing integrated current sensors (ICs) and dedicated analog power ICs. These products significantly contribute to emerging technologies in the automotive and industrial sectors.

Allegro Microsystems’ offerings are organized into three categories: SENSE, featuring Current Sensors, Switches and Latches, linear and Angular Position, Magnetic Speed Sensors, and Photonics; REGULATE, including Regulators and ClearPower Modules; and the third category is DRIVE, with BLDC Drivers, Brush DC, and Stepper Drivers.

Promising New Products

In Q2, the company introduced two new additions to its XtremeSense TMR current sensors line-up. These sensors are the first to be launched since last year’s acquisition of Crocus and offer high resolution and high bandwidth. They are designed with a focus on high power density designs, providing savings in both space and cost while enhancing energy efficiency. Their applications range from automotive powertrain to electric vehicle charging, AI data center, and solar settings.

Allegro formally announced a novel series of Power products, set to be unveiled at Electronica 2024, engineered for performance and efficiency across various sectors, including automotive, industrial, and data center applications. The new lineup includes an advanced suite of drivers designed to tackle the thermal management requirements of hybrid electric vehicles and AI Servers. These mark forward strides in the rapidly evolving power and motor control solutions for the automotive and industrial sectors.

Allegro’s Recent Financial Results & Outlook

The company announced results for the second quarter of FY2025. Net sales of $187 million were in line with expectations, with automotive sales comprising $141 million and industrial and other sales totaling $45 million. Gross margin percentage for the period stood at 45.7%, operating margin was 2.2%, and earnings per share were $0.08, exceeding analysts’ expectations of $0.06.

ALGM’s management has offered guidance for the third quarter of Fiscal year 2025, projecting net sales to range from $170 million to $180 million versus consensus expectations of $204 million. Gross Margin is anticipated to be between 49% and 51%, and diluted earnings per share is expected to be between $0.04 and $0.08.

What Is the Price Target for ALGM Stock?

The stock has been volatile, declining over 22% in the past year. It trades near the bottom of its 52-week price range of $19.71 – $33.26 and continues to show negative price momentum, trading below the 20-day (21.56) and 50-day (22.37) moving averages. However, the price decline has pushed the stock into value territory, with its P/S ratio of 4.6x sitting well below the Semiconductor industry average of 11.5x.

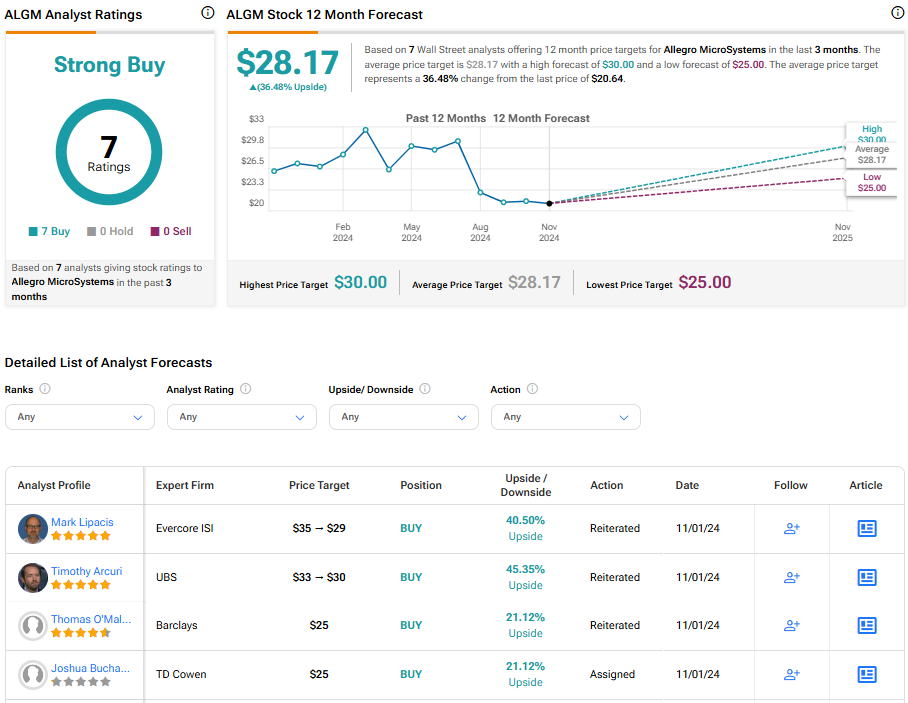

Analysts following the company have been constructive on ALGM stock. For example, Barclays analyst Tom O’Malley recently reiterated an Overweight rating on the shares, even as he lowered the price target from $32 to $25, based on broader industry weakness. However, he thinks investors may want to look to come back to this name first with an industry rebound.

Based on seven analysts’ most recent recommendations, Allegro MicroSystems is rated a Strong Buy overall. The average price target for ALGM stock is $28.17, representing a potential upside of 36.48% from current levels.

Final Analysis on Allegro MicroSystems

Allegro Microsystems continues to influence emerging technologies across the automotive and industrial sectors, launching new products engineered to maximize efficiency within power density designs. Q2 performance was solid, though Q3 guidance reflects anticipated decreases due to lessened demand from China’s EV market. However, the long-term outlook is promising, and the shares trade at a discount, suggesting value-oriented investors have some time to monitor the company closely and look for signs of recovery in overseas markets before taking action on the stock.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue