Alibaba has snatched a deal to buy a stake of up to 9.99% in Dufry as part of a travel online joint venture (JV) in China.

Alibaba (BABA) and Dufry said that they have agreed to enter into a collaboration to jointly invest in opportunities in China to develop the travel retail business and to accelerate Dufry’s digital transformation. As part of the partnership, the parties will incorporate a JV owned 51% by Alibaba and 49% by Dufry. Alibaba plans to invest up to a maximum of 9.99% of the post-offering share capital in Dufry, but no more than 250 million Swiss francs ($273 million), and will participate in its ordinary capital increase, which is subject to approval by Dufry’s shareholders at a meeting on October 6.

With China’s e-commerce giant’s commitment, the rights issue is expected to raise proceeds of about 700 million Swiss francs ($763 million).

Dufry, which first started to operate travel retail businesses in China in 2008, manages duty-paid shops in the Shanghai and Chengdu airports, as well as in Hong Kong and Macau. Now Dufry seeks to expand its digital offerings including store and staff digitalization, pre- and post-travel online services, digital customer engagement and online presence inside and outside of the airport as well as data analytics and digitalization of operations.

Alibaba has already served investors well with its shares surging 36% so far this year as stay-at-home mandates during the outbreak of the coronavirus pandemic forced more and more people to shop online and change their purchase preferences. Following BABA’s 3-day virtual investor day Needham analyst Vincent Yu last week bumped up the stock’s price target to $330 (15% upside potential) from $275 and maintained a Buy rating.

“We were impressed by its continuous efforts in digital innovations in core-commerce, and believe its upgraded app format will help the company capture a greater marketing dollar share,” Yu wrote in a note to investors. “With Alicloud profitability & Cainiao positive operational cash flow on the horizon, we gained confidence in Alibaba’s ability to consistently build out multi-growth engines.”

The analyst added that Alibaba’s 33% in Ant financial should represent about $50 billion in value, while continued innovation will keep it competitive in China’s e-commerce market. (See Alibaba stock analysis on TipRanks).

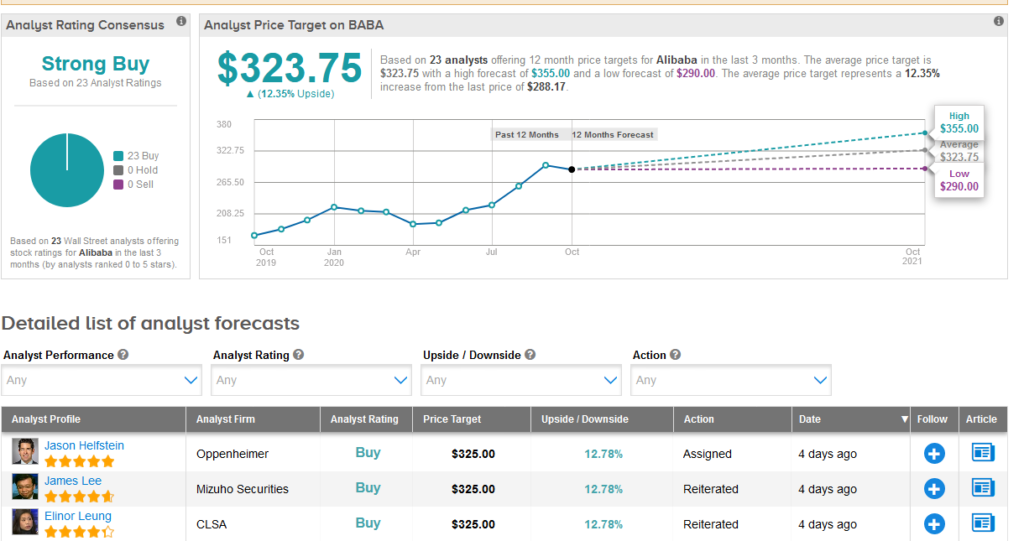

Turning to other Wall Street analysts, the bulls have it all. The Strong Buy consensus boasts 23 unanimous Buy ratings. That’s with a $323.75 average price target indicating that another 12% upside potential lies ahead.

Related News:

Alibaba-Backed XPeng Posts Record EV Deliveries; UBS Sees 37% Upside

Amazon Teams Up With Universal, Warner To Remaster Thousands of Songs

Nvidia Delays GeForce RTX 3070 Availability Date, After Bungled Launch