Chinese e-commerce giant Alibaba (BABA) has reported strong earnings results, with Q4 Non-GAAP EPS of $1.30 easily beating consensus estimates by $0.44 and demonstrating 7% year-over-year growth. GAAP EPS of $0.16 beat Street expectations by $0.04.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Revenue of $16.14B marked 22% year-over-year growth, topping estimates by $860M, due to the solid performance of BABA’s domestic retail businesses and robust cloud computing revenue growth.

“Alibaba achieved the historic milestone of US$1 trillion in GMV [gross merchandise value] across our digital economy this fiscal year,” cheered Daniel Zhang, CEO of Alibaba. “Our overall business continued to experience strong growth, with a total annual active consumer base of 960 million globally, despite concluding the fiscal year with a quarter impacted by the economic effects of the COVID-19 pandemic.”

Meanwhile Maggie Wu, CFO of Alibaba gave a promising outlook for the months ahead, stating: “Although the pandemic negatively impacted most of our domestic core commerce businesses starting in late January, we have seen a steady recovery since March. Based on our current view of Chinese domestic consumption and enterprise digitization, we expect to generate over RMB650 billion in revenue in fiscal year 2021.”

Indeed, annual active consumers on the company’s China retail marketplaces reached 726 million for the quarter ending March 31, an increase of 15 million from December 31, 2019.

Net cash provided by operating activities was RMB2,164 million ($306 million), down from RMB18,553 million in the same quarter of 2019, due to the one-off AliExpress Payment Services Restructuring. Excluding this expense, non-GAAP free cash flow would have been an inflow of RMB1,977 million ($279 million), says BABA.

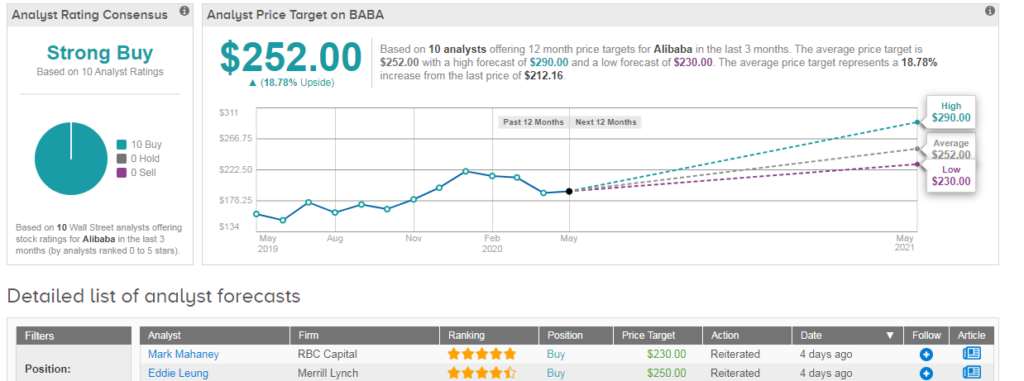

All ten analysts covering Alibaba currently rate the stock a buy- giving it a firm Strong Buy consensus. The $252 average analyst price target indicates upside potential of 19%, with shares currently flat year-to-date. (See Alibaba stock analysis on TipRanks).

“We view the full impact & duration of the Covid-19 outbreak as an unknowable. But we remain very positive on BABA’s long- term fundamental outlook and view valuation as reasonable” comments RBC Capital analyst Mark Mahaney. The analyst has a buy rating on Alibaba, and sees shares reaching $230.

“We are struck by recent government data that details that China Online Retail sales reached ¥8.5T RMB ($1.2T) in 2019 (up 19.5% Y/Y) and amounted to approx. 27% of China’s total retail sales. This scale, growth, and especially penetration all remain impressively robust, and we believe BABA remains the best play on this” he adds.

Related News:

Alibaba to Invest $1.4 Billion into Tmall Genie AI Capabilities

Baidu May Use Nasdaq Delisting To Boost Value – Report

Apple To Reopen More Than 25 U.S. Stores