Alibaba and Swiss luxury brand group Richemont have teamed up to invest $1.1 billion in fashion retail platform Farfetch to meet the growing online demand for luxury brands in the China market.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

As part of the global strategic partnership, Alibaba (BABA) will launch Farfetch luxury shopping channels on its e-commerce sites, Tmall Luxury Pavilion and Luxury Soho, and also invest in the newly formed Farfetch China joint venture together with Richemont. The new channels expand the reach of Farfetch’s global luxury platform to Alibaba’s 757 million consumers. Farfetch is an online luxury fashion retail platform that sells products from boutiques and brands from around the world.

The Chinese luxury market, which is expected to account for half of global luxury sales by 2025, consists of hundreds of millions of young, digitally savvy consumers, Alibaba added.

Specifically, Alibaba and Richemont will invest $300 million each in private convertible notes issued by Farfetch (FTCH). The two companies will also invest $250 million each in Farfetch China, and in return get a combined 25% stake in the new joint venture that will include Farfetch’s marketplace operations in China. As part of the deal, Alibaba and Richemont have an option to purchase an additional combined 24% of Farfetch China after the third year of the joint venture’s formation.

“The new initiatives with Alibaba Group and Richemont extend Farfetch’s strategy to power the digital transformation occurring across the luxury industry, which has been accelerated by the unprecedented challenges resulting from the COVID-19 pandemic,” commented Farfetch CEO José Neves. “The Luxury New Retail initiative will explore ways we can help the wider industry move forward and thrive in the post-COVID world.”

The investments in Farfetch China are expected to be completed during the first half of calendar year 2021, subject to the satisfaction of closing conditions.

Separately, Farfetch announced that Artemis has agreed to increase its existing investment with a $50 million purchase of its Class A ordinary shares.

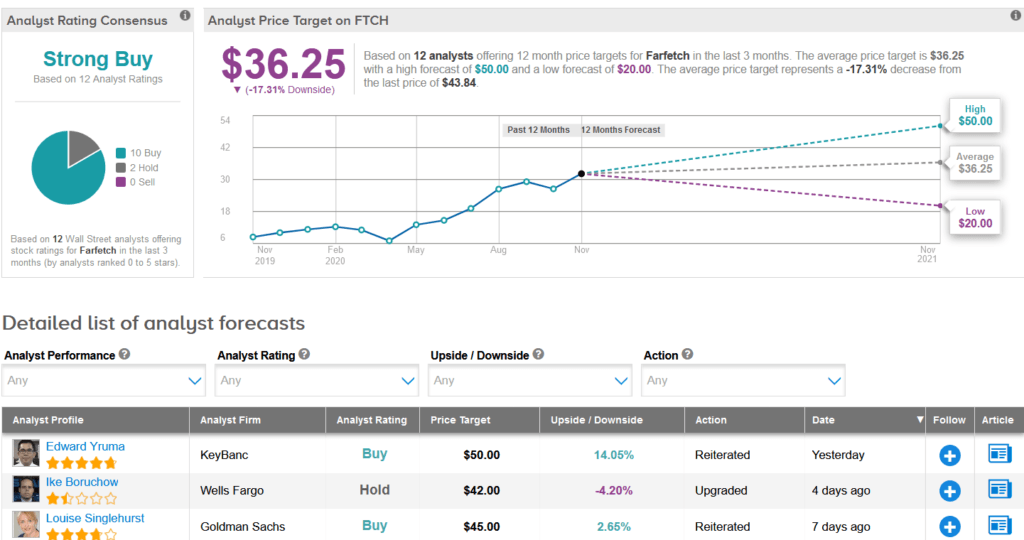

With shares exploding 323% this year, FTCH still scores a Strong Buy consensus from the Street with 10 Buys vs. 2 Holds. However, the $36.25 average analyst price target now implies 17% downside potential.

Meanwhile, Wells Fargo analyst Ike Boruchow last month upgraded FTCH to Hold from Sell describing the stock as an e-commerce pureplay.

“E-commerce is a clear ‘COVID winner’ as the pandemic has dramatically accelerated the channel shift from brick-and-mortar to digital,” Boruchow wrote in a note investors. “We believe the stock moves have been justified.” (See Farfetch stock analysis on TipRanks)

Related News:

VF Snaps Up Supreme Brand In $2.1B Deal; Shares Jump 11%

NextEra Offers $15B To Buy Power Utility Evergy – Report

Orange Buys 54% Stake In Telekom Romania For $318M; Street Sees 29% Upside