Alibaba (BABA) delivered weaker-than-expected Q2 2021 results characterized by revenue and earnings misses. Profit plunged in the quarter as the company continued to invest in key business areas of domestic consumption, globalization, and cloud computing. BABA shares fell 11.1% to close at $143.60 on November 18.

Alibaba is a Chinese company that operates online and mobile marketplaces for retail and wholesale trade. The company operates under four segments: Core Commerce, Cloud Computing; Digital Media, and Entertainment. (See Top Smart Score Stocks on TipRanks)

Q2 Results

The Chinese Internet giant delivered a record 29% year-over-year increase in revenue to $31.15 billion, missing consensus estimates of $32.05 billion. Revenue on international retail and wholesale commerce grew 34% year-over-year to $2.34 billion.

Cloud Computing revenue grew 33% year-over-year to $3.11 billion. The overall revenue increase was driven by the strong performance of the diversified business.

Alibaba delivered diluted earnings per ADS of $1.74, a 38% year-over-year decrease, missing the consensus estimate of $1.93.

The total number of active customers on the Alibaba Ecosystem rose to 1.24 billion for the 12 months ended September 30. The company now has about 953 million consumers in China and 285 million abroad. The company is on course to achieve its target of serving 2 billion consumers globally.

During the quarter, Alibaba repurchased 26.9 million ADS for about $5.15 billion.

Citing inherent risks and uncertainties, Alibaba has updated its guidance and now expects revenue to grow between 20% and 23% year-over-year for fiscal 2022.

Stock Rating

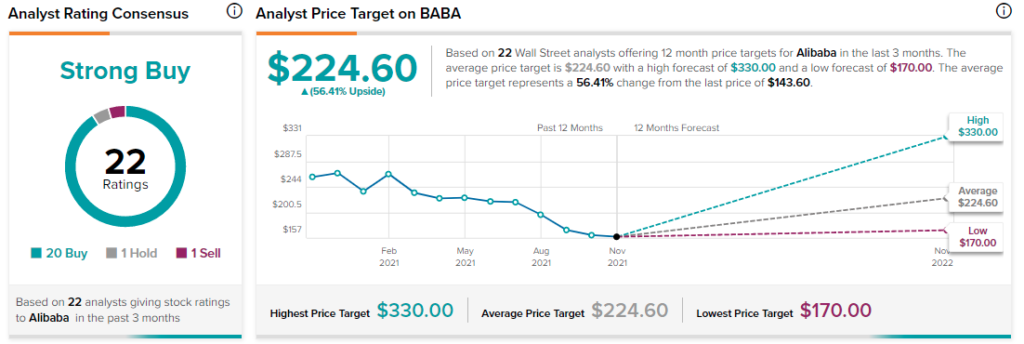

Wednesday, Raymond James analyst Aaron Kessler reiterated a Buy rating on the stock and lowered its price target to $220 from $240, implying 53.2% upside potential to current levels. According to the analyst, China e-commerce should register solid long-term growth, which should benefit Alibaba with an increase in take-rate. The analyst also expects the company to post solid growth in newer areas of Cloud, International, and Local.

Consensus among analysts is a Strong Buy based on 20 Buys, one Hold, and one Sell. The average Alibaba price target of $224.60 implies 56.4% upside potential to current levels.

Related News:

Nvidia Q3 Results Beat Estimates; Issues Guidance

Sun Life Donates C$1M to Kids Help Phone

Galaxy Digital Partners With TIME