Chinese technology giant Alibaba (NYSE:BABA) unveiled Tongyi Qianwen 2.0, its upgraded version of the AI (Artificial Intelligence) model. The company’s Cloud division made this announcement during its annual tech event and said that Tongyi Qianwen 2.0 has significant advancements over its April-launched predecessor. This development takes place in the midst of heightened rivalry among Chinese IT companies as they compete for a larger market share.

Alibaba Intensifies Focus on AI

During the Q1 conference call, Alibaba said that it will continue to invest in AI to enhance users’ shopping experiences. Additionally, Alibaba experienced robust demand for model training and associated AI services on its cloud infrastructure. However, it only partially fulfilled the demand due to the near-term supply chain constraints.

Looking ahead, the company’s ex-CEO, Daniel Zhang, emphasized that the growth potential stemming from AI services has just started. Zhang views AI as a long-term opportunity and highlighted Alibaba’s continued focus on building comprehensive product and technology leadership across various sectors. This strategy is expected to provide a competitive advantage over peers.

Alibaba’s management believes that the combination of high-performance and cost-effective computing power essential for model training and services will open up new avenues for growth. Furthermore, over the long term, Alibaba Cloud stands to gain substantially from the broad adoption of AI in various industries.

While Alibaba is strengthening its AI capabilities, let’s look at the Street’s forecast for BABA stock.

Is Alibaba Stock Expected to Rise?

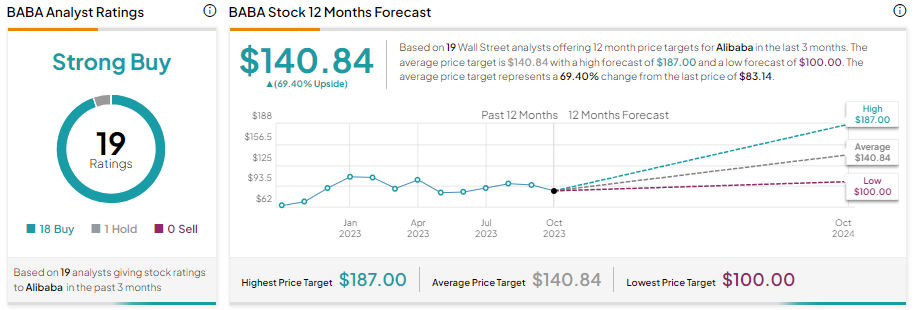

In contrast to its American technology counterparts, Alibaba’s stock has disappointed this year. Shares of this Chinese tech giant are down about 5.6% year-to-date. Nonetheless, Wall Street analysts maintain a bullish outlook on BABA stock.

With 18 out of 19 analysts recommending a Buy on Alibaba stock, it has a Strong Buy consensus rating. Further, the average BABA price target of $140.84 implies a significant upside potential of 69.40%.