Alibaba (BABA) unveiled a new generative AI-driven sourcing agent designed to streamline global trade at its second annual Co-Create event in Las Vegas on Thursday. Additionally, the Chinese e-commerce major introduced a co-branded business credit card with Mastercard (MA). This credit card is expected to boost transactions on the Alibaba platform by offering businesses easier access to capital and enhanced buyer protection.

Details of BABA’s AI Sourcing Agent

The AI sourcing agent will enable buyers to engage with over 200,000 global suppliers using simple conversational language. This advanced search tool will offer real-time translation, along with comprehensive details on suppliers and pricing, supported by over a billion product listings already available on the platform.

Transitioning from the tool’s capabilities, Kuo Zhang, President of Alibaba.com, explained the rationale behind the launch of the AI sourcing agent to Yahoo Finance: “Global trade is a $20 trillion business, but digital penetration [right now] is in single digits. We believe there’s a lot more potential to grow if we lower the barrier.”

Why Has BABA Launched the Sourcing Agent?

Alibaba is increasingly targeting international markets as consumers in its domestic market have become more cautious. In the company’s most recent quarter, Alibaba’s International Digital Commerce Group (AIDC) reported a 32% year-on-year rise in revenue. In contrast, overall company growth, including its Chinese commerce, cloud services, and logistics businesses, was limited to just 4%.

In light of this, Alibaba.com, a key player within AIDC, primarily links global business buyers with suppliers based in China. The U.S. remains one of the website’s largest markets, accounting for 30% to 40% of its gross merchandise volume, according to Zhang. However, the platform’s international reach is expanding rapidly.

Gross merchandise volume is defined as the total value of sales generated by a vendor or supplier through a platform or channel within a specific period.

Is BABA a Good Buy Right Now?

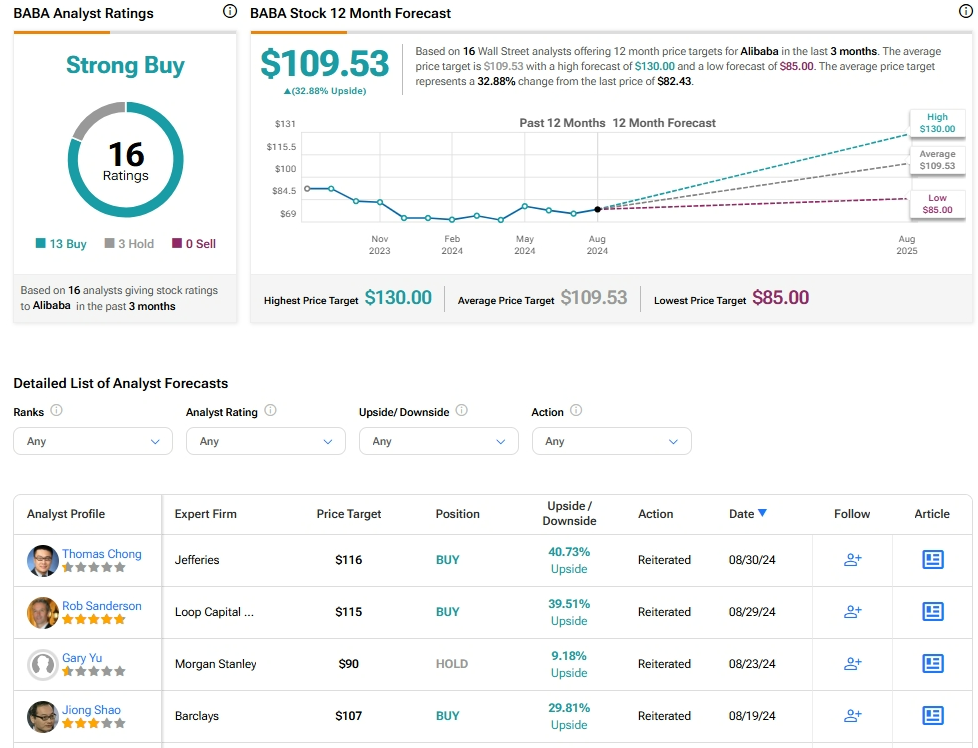

Analysts remain bullish about BABA stock, with a Strong Buy consensus rating based on 13 Buys and three Holds. Over the past year, BABA has declined by more than 9%, and the average BABA price target of $109.53 implies an upside potential of 32.8% from current levels.