Food equipment solutions provider Welbilt Inc. (WBT) recently received a definite proposal and a merger agreement from Ali Holding. Ali Holding is one of the foremost names in the foodservice equipment space.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The Ali Group has offered to acquire all the outstanding shares of Welbilt for a consideration of $24 per share, which represents a premium of 3.5% to Welbilt’s closing price on July 2 and about 11.4% to the implied value of the all-stock transaction with The Middleby Corporation. The Ali Group believes that its business is attuned perfectly with Welbilt and will enhance its product offerings. (See Welbilt stock chart on TipRanks)

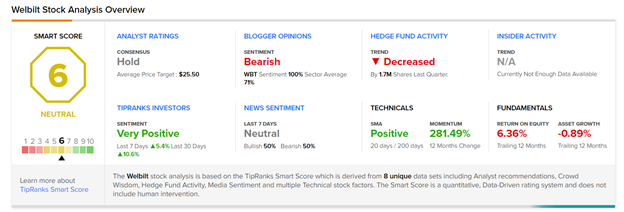

Recently, Robert W. Baird analyst Mircea Dobre downgraded the stock to a Hold with a price target of $26 (12.2% upside potential).

Dobre said, “Driven by recovering foodservice equipment demand and multiple acquisition offers, WBT stock is +83% YTD (S&P500: +12%). Based on an updated prospectus, the negotiation process between WBT and Ali Group continues (currently $23.00/ share cash offer) while MIDD maintains its all-stock offer ($20.56 at current MIDD stock level); both offers below WBT’s current stock price ($24.16). Even if MIDD eventually increases its offer, we see limited upside from here (e.g., $5/share cash component to MIDD’s current offer implies ~$25.50/share at current levels, ~6% upside).”

Consensus among analysts is a Hold based on 4 unanimous Holds. The average Welbilt price target stands at $25.50, which implies upside potential of 10%.

Welbilt scores a 6 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with the market averages. Shares have gained 301.7% over the past year.

Related News:

Alpine Immune Announces Equity Offering Totaling $75M

GMS Completes Acquisition of Westside; Street Says Buy

Sun Life Closes PinnacleCare Acquisition