Algonquin Power & Utilities (TSE: AQN) announced that Liberty Utilities (Eastern Water Holdings), a wholly owned subsidiary of AQN’s regulated utility operating subsidiary, Liberty Utilities Co., has successfully completed the previously announced acquisition of New York American Water Company, Inc. from American Water Works Company, Inc.

The purchase price is approximately $608 million.

An Important Water Utility Acquisition

New York American Water, based in Merrick, New York, is a regulated water and wastewater utility serving more than 125,000 customers in seven counties in southeastern New York.

New York American Water’s operations include approximately 1,270 miles of water and distribution lines, with 98% of customers in Nassau County on Long Island.

As part of Liberty’s operating model, local operations teams will be empowered to provide the safe and reliable service customers expect. To this end, Liberty plans to bring the customer service function back to Long Island, which is expected to increase local employment and improve the quality of service provided to customers.

Management Commentary

AQN President and CEO Arun Banskota said, “We are pleased to complete this important water utility acquisition, and to bring New York American Water’s employees and customers into the Liberty family. Since announcing the transaction, we have been working closely with the New York American Water team and local authorities and regulators in an effort to facilitate a smooth transition of services, and to understand the needs of our customers in these communities. We have a strong track record as a water utility owner and operator, and we are eager to bring that expertise to Long Island.”

Wall Street’s Take

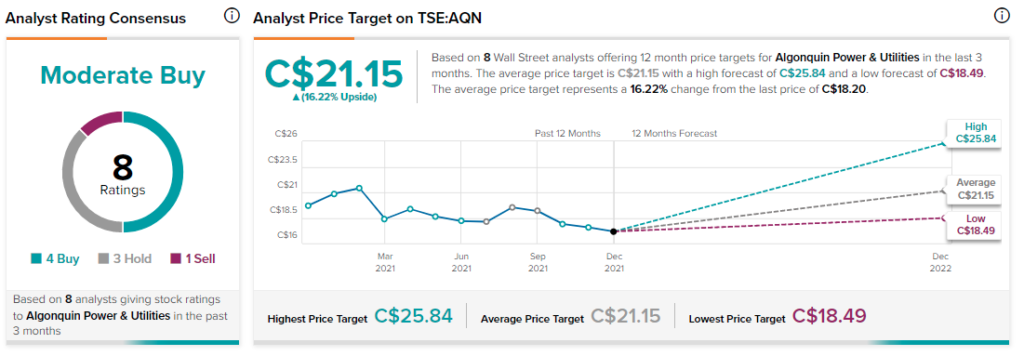

On December 16, Bank of America Securities analyst Julien Dumoulin-Smith kept a Sell rating on AQN while lowering its price target to $14.50 (C$18.49). This implies 1.6% upside potential.

Overall, AQN scores a Moderate Buy consensus rating among analysts based on four Buys, three Holds, and one Sell. The average Algonquin Power & Utilities price target of C$21.15 implies 16.2% upside potential to current levels.

Download the mobile app now, available on iOS and Android.

Related News:

Enbridge Closes Deal to Sell Noverco’s Stake

Secure Energy Added to S&P/TSX Composite Index