Albertsons Companies, Inc. (NYSE: ACI) reported stronger-than-expected fiscal Q3 results. Driven by favorable economic conditions and robust performance across frontline retail, distribution, and manufacturing segments, ACI topped both earnings and revenue estimates.

Furthermore, the American food and drug retailer also raised its FY2021 guidance well above analysts’ expectations.

However, investors were disappointed as higher revenues didn’t convert to higher margins due to higher labor and logistics costs and inflation, and supply chain pressures.

Likewise, despite the quarterly beat and raised guidance, ACI shares dropped 9.7% to close at $28.79 on January 11.

Stellar Q3 Outperformance

Markedly, adjusted earnings of $0.79 per share grew 19.7% year-over-year and exceeded analysts’ expectations of $0.58 per share. The company reported earnings of $0.66 per share for the prior-year period.

Similarly, revenues jumped 8.4% year-over-year to $16.7 billion and exceeded consensus estimates of $16.03 billion. The increase in revenues reflects a surge in identical sales, which increased 5.2% driven by retail price inflation and incremental sales related to administering COVID-19 vaccines.

However, despite the stellar revenue beat, gross margin declined 40bps to 28.9% year-over-year due to higher fuel costs as well as higher product costs, which was driven by the current inflationary environment and higher supply chain costs.

Concurrent with the earnings announcement, the company announced the next quarterly dividend of $0.12 per share of Class A common stock payable on February 10, to shareholders on record as of January 26.

Raised Fiscal 2021 Outlook

Based on strong Q3 results, the company raised its guidance for fiscal 2021. The company now forecasts adjusted earnings in the range of $2.90 to $2.95 per share against the previous guidance of $2.50 to $2.60 per share. The consensus estimate is pegged at $2.61 per share.

Additionally, identical sales are projected to grow in the range of (0.8%) to (1.2%) compared to FY2020, and better than the prior guided growth range of (2.5%) to (3.5%). On a 2-year stack basis, identical sales are expected to grow 15.7% to 16.1% compared to the previously guided range of 13.4% to 14.4%.

CEO Comments

Sharing his views on the Q3 results, ACI CEO, Vivek Sankaran, said, “Also driving these results was our continued focus on in-store excellence, acceleration of our digital and omnichannel capabilities, and delivery of our productivity initiatives. During the quarter, we continued to gain market share in both units and dollars and saw ongoing improvement in both the in-store and online customer experience.”

Wall Street’s Take

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 3 Buys and 5 Holds. The average Albertsons Companies price target of $33.38 implies 15.9% upside potential to current levels.

Bloggers Weigh In

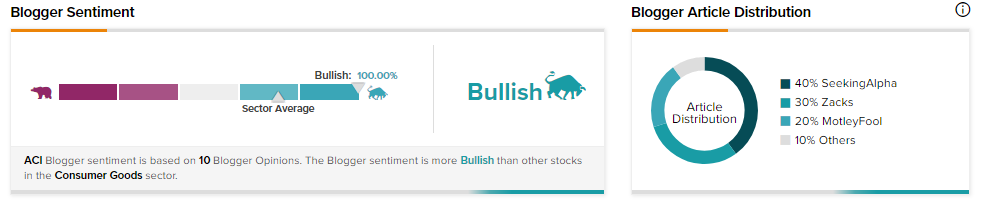

TipRanks data shows that financial blogger opinions are 100% Bullish on ACI stock, compared to a sector average of 73%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Download the TipRanks mobile app now

Related News:

Accolade Posts Stellar Q3 Results; Shares Up 11.3%

Abercrombie & Fitch Sees Robust Demand; Shares Up 5.6%

Aptiv to Snap up Wind River From TPG for $4.3B

Questions or Comments about the article? Write to editor@tipranks.com