Albemarle (NYSE:ALB) stock nosedived to a 52-week low of $90.32 yesterday after Robert W. Baird analyst Ben Kallo cut the price target to $127 from $170 owing to declining lithium prices. The analyst also lowered his model estimates for Albemarle, the world’s largest lithium miner, to reflect the soft prices and the demand-supply scenario. Kallo expects earnings per share (EPS) of $0.00 in Q2 and $1.96 for the full-year Fiscal 2024.

Albemarle shares lost 8.7% on July 9, touching the lowest levels since 2020. The company is set to release its Q2 FY24 results on July 31, after the market closes. The Street expects Albemarle to post adjusted EPS of $0.58 on revenues of $1.37 billion. These estimates compare highly unfavorably to Q2 FY23 when ALB posted adjusted EPS of $7.33 on net sales of $2.37 billion. Lithium market prices remained at highly elevated levels in 2022-2023, boosting Albemarle’s performance.

Here’s Why Kallo Cut ALB’s Price Target

Kallo maintained a Buy rating on ALB stock, given his conviction in the company’s long-term potential. At the same time, he noted that the year-to-date lithium prices have remained at or below the bottom range of the guidance ($15 per kilogram). The depressed prices are poised to impact Albemarle’s second quarter performance, Kallo added. Furthermore, prices continue to remain under pressure in July as well, leading to uncertainty about the company’s future performance.

Moreover, Kallo is concerned about the impact of the U.S. presidential elections on electric vehicle (EV) tax credits. The analyst stated that EV manufacturers may want to hold off on boosting production or committing to stringent transition targets until they get more clarity after the election.

Is Albemarle Stock a Buy or Sell?

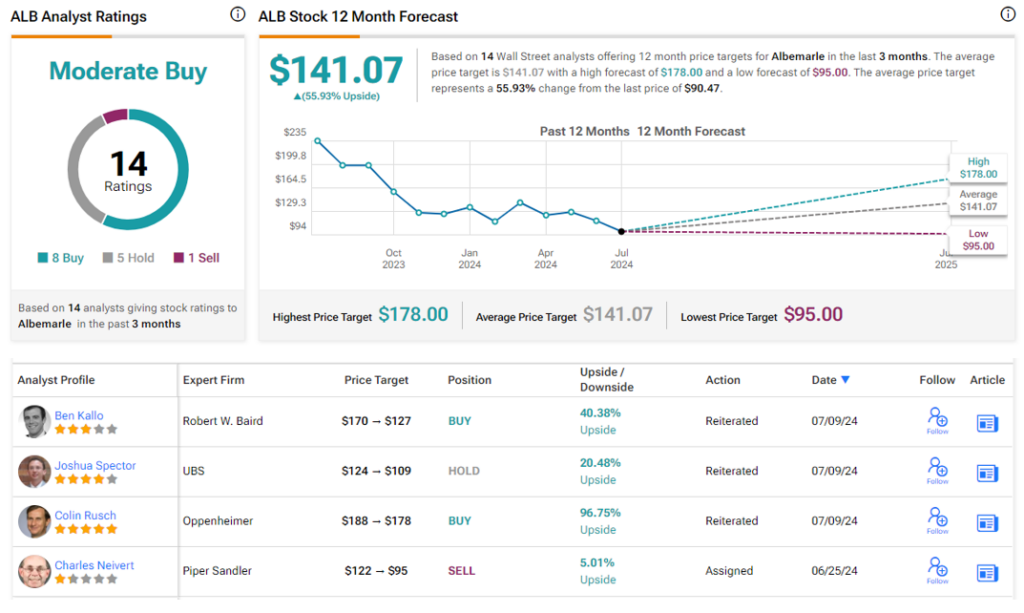

On TipRanks, ALB stock has a Moderate Buy consensus rating based on eight Buys, five Holds, and one Sell rating. Aside from Kallo, other analysts have also cut their price targets on ALB stock, citing similar lithium price concerns and Q2 performance. The average Albemarle Corporation price target of $141.07 implies 55.9% upside potential from current levels. Meanwhile, ALB shares have declined nearly 37% so far in 2024.