Alaska Air Group is forecasting a 40% capacity reduction in the fourth quarter as the COVID-19 pandemic continues to have an unprecedented impact on travel demand. The airline expects capacity to be down 45% and revenue to fall about 65% in October following a 50% capacity slump and 66% revenue decline in September.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

“We are uncertain what shape the recovery will take, and we are continuously monitoring trends in demand to determine our capacity decisions as the situation unfolds,” the company stated in an SEC filing on Tuesday. Alaska Air (ALK) anticipates capacity reductions to continue into 2021 and has started right-sizing its workforce.

To mitigate potential furloughs, the company is offering early-out programs to its frontline workers and extended incentive leaves to pilots and aircraft mechanics. Over 4,000 employees have accepted these offers.

At the beginning of this month, Alaska Air placed about 400 employees, mainly flight attendants, on an involuntary furlough. However, the company expects to recall many of these employees by the end of this year based on current capacity and network expectations. The airline will record a one-time charge of $320 million in 3Q in connection with the early-out, incentive leave and non-union management reductions.

Meanwhile, Alaska Air expects October cash burn to come in at about $125 million, which indicates a deterioration compared to $117 million in September. The October cash burn estimate excludes the $30 million payment related to the company’s furlough mitigation programs. (See ALK stock analysis on TipRanks)

On Sept. 28, Alaska Air reached an agreement with the U.S. Department of the Treasury to borrow up to $1.9 billion under the CARES Act loan program and has drawn $135 million to date. The company said that the remaining amount is available to draw through Mar. 31, 2021. As of Oct. 9, Alaska Air had cash and short-term investments of about $3.6 billion.

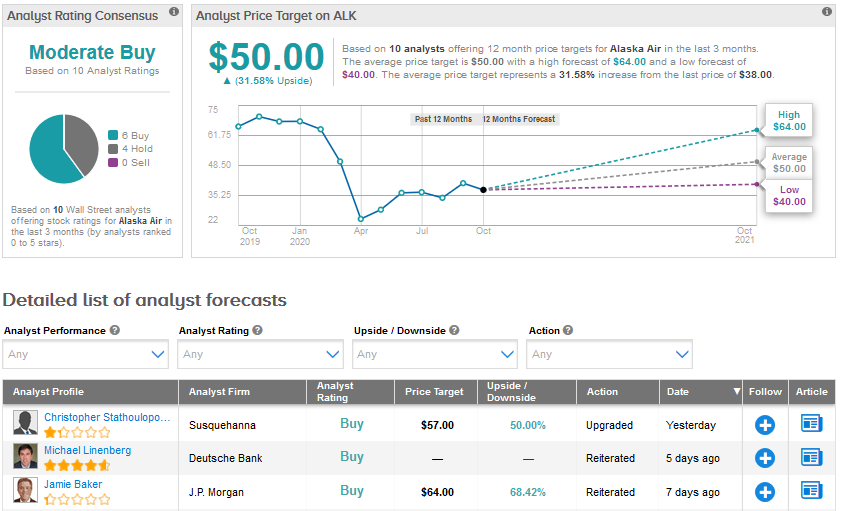

Yesterday, Susquehanna analyst Christopher Stathoulopoulos upgraded Alaska Air to Buy from Hold and maintained his Buy rating for Delta Air Lines (DAL) and Southwest Airlines (LUV) stating that he is keen about “airlines that are built for low cost (or said another way, point-to-point carriers with homogenous fleets) and, importantly, have solid liquidity runways.”

He cited Alaska’s “ample cash” and a relatively young fleet among its positives. Stathoulopoulos raised his price target for the stock to $57 from $35.

Overall, 6 Buys, 4 Holds, and no Sells add up to a Moderate Buy consensus for Alaska Air. The stock has declined 44% so far this year. The average analyst price target of $50 indicates an upside potential of 31.6% in the months ahead.

Related News:

Delta Sinks On Huge Q3 Loss As Covid-19 Hurts Travel Demand

Southwest Airlines To Expand Footprint In Chicago and Houston

Air Canada Chops Transit Takeover Price By 74% Due To Covid-19 Crisis