Alaska Air announced on Monday that it will lease 13 new Boeing 737-9 Max aircraft from aircraft lessor Air Lease Corp., just as the US Federal Aviation Administration (FAA) last week lifted the flying ban on the Max jets. Boeing shares advanced another 1.5% in Monday’s extended market session after closing 6% higher.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Alaska Air (ALK) said that the 13 Max aircraft will be delivered from the fourth quarter of 2021 through 2022. The move comes after the FAA last week suspended the 20-month grounding order that halted commercial operations of Boeing’s 737-8s and 737-9s, following two fatal crashes.

The ailing planemaker said that the FAA move will allow airlines that are under its jurisdiction, including those in the US, to take the steps necessary to resume services and for Boeing (BA) to begin making deliveries. For now, commercial flights are scheduled to start on Dec. 29, just under six weeks after the FAA order was published on Nov 18.

The 13 leased aircraft are in addition to the 32 Max Alaska Air currently has on order with Boeing, five of which are expected to be flying by summer 2021. The airline expects to start flying the 737-9 Max in March 2021. Furthermore, Alaska Air disclosed that as part of this deal, it will sell 10 Airbus A320s to Air Lease. After permanently parking all A319s and some A320s earlier this summer, it now leaves Alaska Air with 39 A320s in the operating fleet along with 10 A321neos.

Alaska Air said that the Max aircraft are 20% more fuel efficient and generate 20% less carbon emissions per seat than the A320s they will replace. The Max aircraft can fly 600 miles farther than Alaska’s current A320, which opens the possibility of additional nonstop routes and new destinations, the airline added.

Shares of BA have tanked 35% year-to-date as the coronavirus travel restrictions have resulted in a deep cut in the number of commercial jets and services Boeing customers need over the next few years. As such, global airlines suffering billions of dollars in losses have been seeking to cancel or delay some of the orders they have with Boeing, including the grounded 737 Max. The stock jumped 32% over the past month as investors anticipated the recertification of the Max aircraft.

Merrill Lynch analyst Ronald Epstein just raised BA’s price target to $230 (8.7% upside potential) from $175, saying that the FAA’s lifting order is “a major milestone towards the MAX flying once more, which significantly reduces risk to Boeing’s equity.”

However, Epstein reiterated a Hold rating on the stock as he argues that there are “some company specific challenges ahead, including the 787 move to South Carolina, further cuts to 787 production rate, 737 Max delivery rate and ramp up, time required to burn off 450 Max aircraft sitting on Boeing’s inventory, and cash burning defense programs.” (See BA stock analysis on TipRanks)

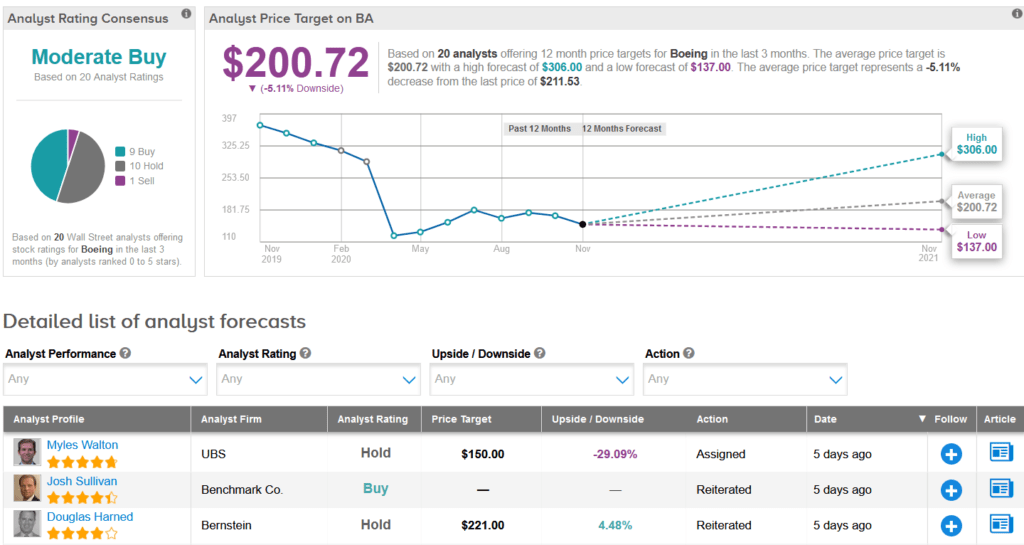

The rest of the Street has a cautiously optimistic Moderate Buy analyst consensus on the stock. That’s with an average analyst price target of $200.72, indicating downside potential of 5.1% lies ahead over the coming 12 months.

Related News:

Boeing 737 Max Europe Flying Ban Seen Lifted In January – Report

Nasdaq To Snap Up Verafin For $2.75B In Fraud Detection Push

FireEye Surges 17% On Investment & Acquisition Deal, Analyst Lifts PT