Shares of the travel accommodation provider Airbnb (ABNB) are down about 14% since the second quarter results were announced on August 6. The soft Q3 revenue guidance and concerns around slowing travel demand in the U.S. disappointed investors. Following the Q2 earnings release, analysts largely maintained a Hold rating on ABNB stock and lowered their price targets.

With this backdrop, let’s delve into some of the analysts’ comments.

Analysts Suggest Holding ABNB Stock

Needham analyst Bernie McTernan maintained a Hold rating on the stock, citing concerns over Airbnb’s ability to sustain its growth trajectory. McTernan noted that ABNB’s lack of a clear expansion strategy beyond its core business and challenges in transitioning towards an AI-powered platform raise concerns about the company’s future performance.

Also, Robert W. Baird analyst Colin Sebastian reiterated his Hold recommendation on Airbnb stock after the Q2 earnings report and decreased his price target to $120 from $140. The five-star analyst pointed out increasing concerns over reduced consumer spending, suggesting that travelers may delay or cut back on trips.

Is Airbnb a Buy or Sell?

After the Q2 earnings call, five analysts reiterated a Buy rating on the stock, while 14 rated it a Hold, and four gave a Sell rating. Among the optimistic analysts, Kevin Kopelman from TD Cowen expects moderate booking growth in Q3 and Q4, with new marketing initiatives expected to drive revenue in 2025.

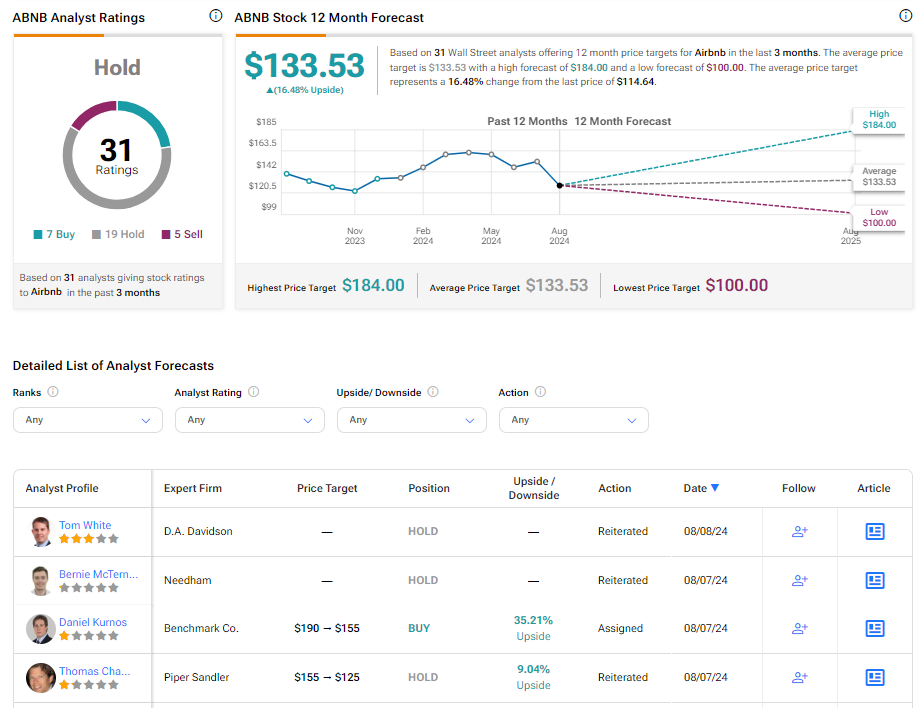

Overall, ABNB has a Hold consensus rating on TipRanks. This is based on seven Buy, 19 Hold, and five Sell recommendations. Analysts’ average price target on Airbnb stock is $133.53, implying a 16.48% upside potential from current levels.

Bottom Line

Airbnb’s Q3 guidance indicates a slowdown in booking growth, especially in the US, which could pose challenges for maintaining revenue growth. However, the company’s emphasis on new marketing initiatives to boost bookings may support long-term growth.