Air Products and Chemicals (NYSE:APD) shares plummeted by nearly 10% in the early session today after the industrial gases and associated services provider delivered lower-than-expected numbers for the first quarter. Revenue declined by 5.6% year-over-year to $3 billion, missing the Street’s expectations by $200 million. In sync, EPS of $2.82 lagged estimates by $0.18.

At the same time, APD’s adjusted EBITDA increased by 8% to $1.2 billion, driven by higher pricing, increased volumes, and a rise in equity affiliates’ incomes. These gains were partially offset by an increase in costs.

Nonetheless, near-term headwinds persist. APD is experiencing a slowdown in China, lower demand for helium, and an adverse currency impact in Argentina. Despite these challenges, APD expects its adjusted EPS for the full year to rise by 6% to 9%, reaching a range of $12.20 to $12.50. Adjusted EPS for the upcoming quarter is seen landing between $2.60 and $2.75.

Further, APD increased its quarterly dividend to $1.77 per share last month. The APD dividend is payable on May 13 to investors of record on April 1.

Is APD Stock a Buy, Sell, or a Hold?

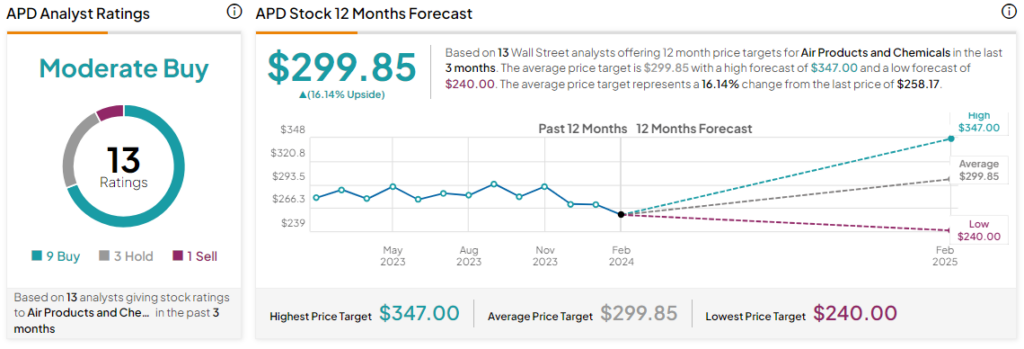

Shares of the company have declined by nearly 13% over the past year. Overall, the Street has a Moderate Buy consensus rating on Air Products, and the average APD price target of $299.85 points to a 16.1% potential upside in the stock.

Read full Disclosure