Describing an airline stock as being “in a nosedive” is probably in poor taste, but when you’re Air Canada (TSE:AC) and down around 8% in Thursday morning’s trading, it’s not too far out of line. What happened to prompt such trouble for the airline? Its earnings report emerged, and what it had to say proved unwelcome to everybody.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Air Canada’s earnings report didn’t turn out well at all. Not only did it post a loss of C$0.27 per share, but that loss was nearly three times larger than what analysts expected. And, to add insult to injury, Air Canada posted that earnings miss at a time when its revenue was up and above estimates. It brought in C$5.23 billion for the quarter, which exceeded analysts’ expectations of C$5.19 billion, and it also beat the first quarter of 2023’s figures by 7%.

However, the company’s guidance offered some positive points, as Air Canada revealed that demand for air travel was on the rise, particularly from the corporate sector. Indeed, corporate demand was up somewhere between 10% and 20%.

New Routes Don’t Hurt Either

While that news was mixed, the addition of some new routes should be pretty welcome. St. Louis, Missouri’s Lambert International Airport just got a new route from Air Canada, featuring direct flights to Quebec. Those will be seasonal flights, so they won’t be happening all the time. But still, it’s good news for anyone looking for an unusual summer destination and might be a good way to help turn around some of the losses and augment that corporate demand.

What Is the Future Price of Air Canada Stock?

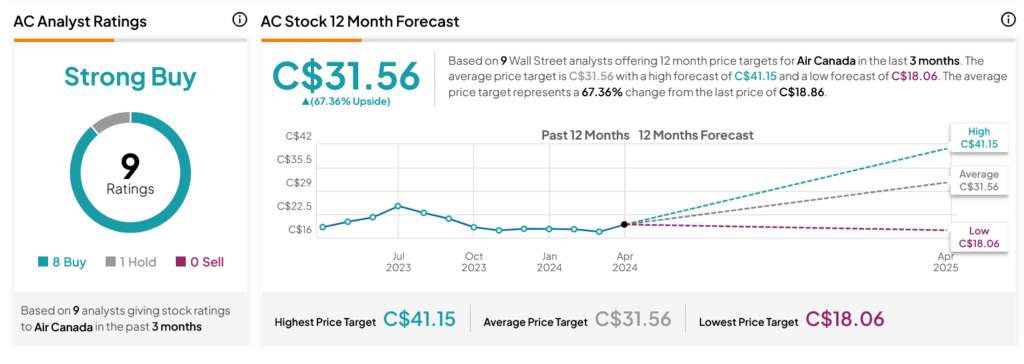

Turning to Wall Street, analysts have a Strong Buy consensus rating on Air Canada stock based on eight Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 0.05% loss in its share price over the past year, the average Air Canada price target of C$31.56 per share implies 67.36% upside potential.