The negotiations between Canadian airline Air Canada (TSE:AC) and its pilots union are not going well, at last report. But this is not dampening enthusiasm among investors, who have stepped up to put new cash behind it, sending shares up over 2% in Thursday morning’s trading.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The latest reports suggest that “tensions are mounting,” as the pilots at Air Canada are now just days away from either a strike or a lockout and there have been few moves made to narrow the gap between Air Canada and its pilots.

In fact, earlier this week, Air Canada noted that there was a growing likelihood that some kind of work stoppage would come into play. Talks between the two sides are still “far apart,” and a 72-hour notice period could emerge as soon as Sunday. Moreover, a complete work stoppage event could be less than a week away as the contracts end on September 18. And in a demonstration of how far apart the two sides are, Air Canada calls the pilots’ wage demands “excessive,” while the union is calling out Air Canada for “corporate greed.”

Calling for Help

The loss of Air Canada, meanwhile, would certainly put a crimp in a lot of travel plans, both business and recreational. That means a lot of potential tourism dollars lost as well as business impacted. Thus, more and more groups are calling on the government to get involved before the shutdowns hit.

In fact, over 100 Canadian business groups got together to urge the government to step in and prevent the strike from happening in the first place. This is similar to what just happened with Canadian rail service, a move that reduced striking to minimal levels and got the country back on track. With the groups in question noting that this move will damage Canada’s reputation for reliability as a trading partner, it would seem the government has a valid interest in getting involved.

Is Air Canada a Good Investment?

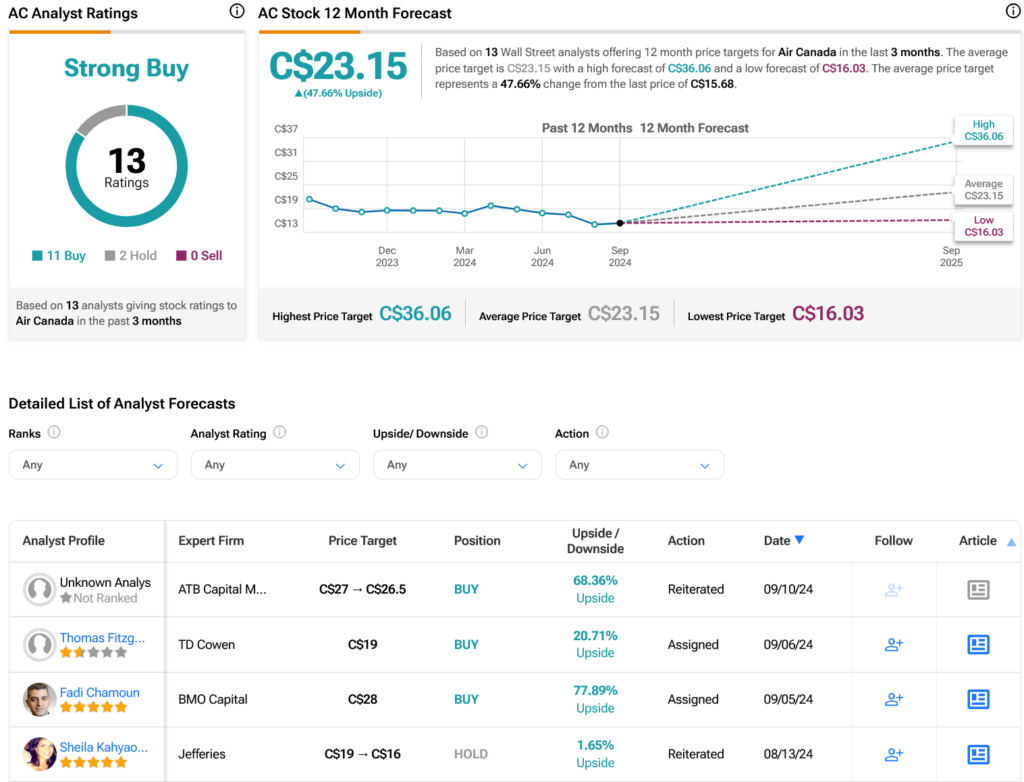

Turning to Wall Street, analysts have a Strong Buy consensus rating on TSE:AC stock based on 11 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 23.74% loss in its share price over the past year, the average TSE:AC price target of C$23.15 per share implies 47.66% upside potential.