Air Canada (TSE: AC) reported a smaller loss and a higher revenue in the fourth quarter as travel recovery is gaining speed despite the impact of the Omicron variant on holiday travel.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Revenue & Earnings

Operating revenues for Q4 2021 came in at C$2.731 billion, more than three times higher than the operating revenues of C$827 million reported in Q4 2020.

Air Canada reported a net loss of C$493 million (C$1.38 per diluted share) in the quarter ended December 31, compared to a loss of C$1.161 billion (C$3.91 per diluted share) in the prior-year quarter.

Operational capacity increased by 134% in the quarter compared to the corresponding period of 2020. This result is still 47% lower than in the fourth quarter of 2019.

CEO Commentary

Air Canada president and CEO Michael Rousseau said, “Our quarterly EBITDA exceeded our expectations and turned positive for the first time in seven quarters, cash flow from operations remained positive and accelerated from the third quarter, and we ended the year with $10.4 billion in unrestricted liquidity, an increase of $2.3 billion, or about 29 per cent from the start of the year. We grew our capacity 26 per cent from the previous quarter, while continuing to successfully manage load factor and yields in the right direction. Prior to Omicron’s onset, ticket sales reached 65 per cent of pre-pandemic levels in October and November. These are all encouraging indicators. Moreover, robust advance ticket sales, which grew almost $400 million in the quarter, give us confidence that our customers will keep returning and that Omicron’s effect on our business is travel deferred, not cancelled.”

Wall Street’s Take

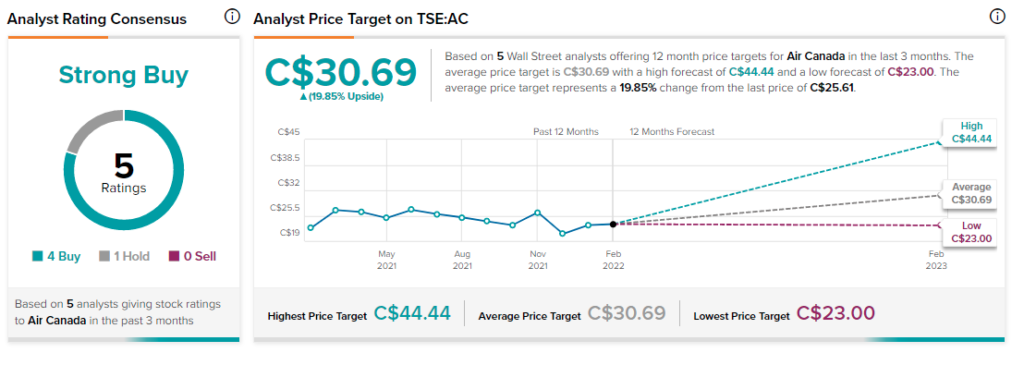

On February 15, Scotiabank analyst Konark Gupta kept a Buy rating on AC and lowered its price target to C$29 (from C$31). This implies 13.3% upside potential.

The rest of the Street is bullish on AC with a Strong Buy consensus rating based on four Buys and one Hold. The average Air Canada price target of C$30.69 implies 19.9% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

Keyera Swings to Profit in Q4

TC Energy Q4 Profit Falls, Dividend Raised

Enbridge Posts Higher Q4 Profit